Tag: Mortgage

Simplifile Recognized as HW Tech100 Winner for Fourth Consecutive Year

PROVO, Utah, April 2, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents, and counties, announced that it has been included on the sixth annual HW Tech100 list published by housing and mortgage industry trade magazine HousingWire.

NEXT Mortgage Events Wins PROGRESS in Lending Innovations Award

EDMOND, Okla., March 29, 2019 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events LLC, creator of the NEXT women's mortgage tech summit, has announced that it was named a winner of the Innovations Award from PROGRESS in Lending Association.

DocMagic Earns a Spot on the HW TECH100 For the Sixth Straight Year

TORRANCE, Calif., March 29, 2019 (SEND2PRESS NEWSWIRE) -- DocMagic, Inc., the premier provider of dynamic loan document preparation, automated regulatory compliance and comprehensive eMortgage solutions, announced that HousingWire has honored the company with the HW TECH100(tm) award for the sixth year in a row.

FormFree Joins the Financial Data Exchange (FDX)

ATHENS, Ga., March 26, 2019 (SEND2PRESS NEWSWIRE) -- FormFree announced today that it has joined the Financial Data Exchange (FDX), a non-profit group that promotes information sharing and security standards for the financial sector. A leading provider of digital asset, income and employment verification, FormFree brings over a decade of experience in protecting the safety and integrity of sensitive consumer data.

Mid America Mortgage COO Kara Lamphere Honored as 2019 ‘Tech All-Star’

ADDISON, Texas, March 26, 2019 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. announced today that Mid America Chief Operating Officer Kara Lamphere was one of four mortgage technology innovators honored by the Mortgage Bankers Association (MBA) as a 2019 MBA Insights Tech All-Star. The award, now in its 18th year, recognizes "industry leaders who have made outstanding contributions in mortgage technology."

Home Point Financial Partners with Matic to Offer Lowest Market Rates on Homeowners Insurance

COLUMBUS, Ohio, March 26, 2019 (SEND2PRESS NEWSWIRE) -- Digital insurance agency Matic announced today that it has partnered with Home Point Financial Corporation ("Home Point"), a national, mortgage originator and servicer, to help its mortgage servicing customers find competitively priced homeowners insurance.

Global DMS Launches SnapVal to Provide Instant Guaranteed Appraisal Pricing Early on in the Origination Process

DALLAS, Texas, March 25, 2019 (SEND2PRESS NEWSWIRE) -- MBA's Technology Solutions Conference & Expo -- Global DMS, a leading provider of cloud-based valuation management software, today announced the official rollout of SnapVal(TM), an automated solution that utilizes the property address to return a guaranteed price on any residential appraisal in the U.S.

IDS Inc. Adds Full Mortgage eClosing Capabilities with Release of ClickToClose

SALT LAKE CITY, Utah, March 25, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has augmented its flagship doc prep platform idsDoc to include full eClosing capabilities through a new service called ClickToClose.

LBA Ware CEO Lori Brewer Selected as 2019 Tech All-Star by Mortgage Bankers Association

MACON, Ga., March 25, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware(TM), provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that company Founder and CEO Lori Brewer has been named a winner of the 2019 MBA Insights Tech All-Star award. Brewer accepted her award today during the opening session of the Mortgage Bankers Association's Technology Solutions Conference & Expo 2019 in Dallas.

NotaryCam and DocMagic Integration Delivers Remote Online Notarization, eClosing Capabilities for Mid America Mortgage

NEWPORT BEACH, Calif., March 25, 2019 (SEND2PRESS NEWSWIRE) -- NotaryCam, the leader in online notarization solutions, today announced that eMortgage pioneer Mid America Mortgage is now using the firm's integration with DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, to conduct remote online notarizations (RONs) through DocMagic's Total eClose platform.

OpenClose Extends its Digital Mortgage Ecosystem with New ConsumerAssist Digital POS

WEST PALM BEACH, Fla., March 22, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and mortgage fintech provider, announced that it is has scheduled a May release for the official rollout of its much anticipated digital mortgage point-of-sale (POS) solution, ConsumerAssist Digital POS.

NEXT Mortgage Conference Announces Summer Dates: Aug. 26-27, 2019 in Chicago

EDMOND, Okla., March 21, 2019 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events LLC, creator of the NEXT women's mortgage tech summit, has announced its summer 2019 event dates. The event, hashtagged #NEXTSummer19, will take place Aug. 26-27, 2019 at The Gwen Hotel in Chicago. Registration will open to the public in April 2019.

National Association of Appraisers and Anow forge partnership to bring cutting edge appraisal software to real property appraisers members

SAN ANTONIO, Texas and RED DEER, Alberta, March 19, 2019 (SEND2PRESS NEWSWIRE) -- Anow, creator of the leading software for real estate appraisal offices, today announced it has forged a partnership with the National Association of Appraisers (NAA) to make Anow's appraisal office management platform more readily accessible to members of the professional organization.

MCT’s CMO Ian Miller Designated a 2019 ‘Top 40 Most Influential Mortgage Professionals Under 40’ by NMP Magazine

SAN DIEGO, Calif., March 15, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading, Inc. (MCT) a leading mortgage hedge advisory and secondary marketing software firm, announced that its Chief Marketing Officer, Ian Miller, was recognized by National Mortgage Professional Magazine's (NMP) for his industry accomplishments, landing him on the 2019 'Top 40 Most Influential Mortgage Professionals Under 40' list.

MQMR’s Britt Haven Receives Certification from MBA’s Certified Mortgage Compliance Professional Program

LOS ANGELES, Calif., March 15, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage Quality Management and Research, LLC (MQMR) announced today that its National Account Executive Britt Haven has completed Level I of the Certified Mortgage Compliance Professional (CMCP) Certification and Designation program offered by the Mortgage Bankers Association (MBA).

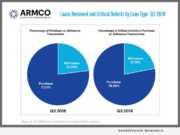

Q3 2018 Mortgage QC Trends Report from ARMCO: Defect Trends Reflect Lower Volume, Hyper-Competitive Market

POMPANO BEACH, Fla., March 14, 2019 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the release of the quarterly ARMCO Mortgage QC Trends Report. The latest report covers the third quarter (Q3) of 2018, and provides loan quality findings for mortgages reviewed by ACES Audit Technology.

OpenClose LOS Platform, POS System and PPE Receives the Highest Overall Satisfaction and Lender Loyalty Score in STRATMOR’s New ‘Technology Insight...

WEST PALM BEACH, Fla., March 14, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that STRATMOR Group's most recent Technology Insight Survey ranked the company's LOS platform, point-of-sale (POS) system, and product and pricing engine (PPE) as having the highest Overall Satisfaction and Lender Loyalty Score out of any vendor surveyed in the mortgage industry.

The Mortgage Collaborative Adds New Board Members and Lender Members and Grows Attendance at 2019 Winter Conference

SAN DIEGO, Calif., March 13, 2019 (SEND2PRESS NEWSWIRE) -- The Mortgage Collaborative, a fast-growing independent mortgage cooperative of banks, credit unions and mortgage bankers, continues growth initiatives by adding three new mortgage executives to its Board of Directors. The new board members were voted in at their bi-annual member conference held in Austin, Texas.

ReverseVision Voted ‘Best in Show’ by Attendees of 2019 NEXT Women’s Mortgage Event in February

EDMOND, Okla., March 11, 2019 (SEND2PRESS NEWSWIRE) -- NEXT Mortgage Events LLC, a creator of events for women mortgage executives, has announced that ReverseVision has been voted Best in Show for the live technology showcase at its February 2019 technology conference. This distinction is awarded to the technology showcase participant that presented the most compelling solution, as determined by attendee vote.

Mid America Mortgage Earns Multiple 2018-19 Top Mortgage Workplace Honors

ADDISON, Texas, March 8, 2019 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. (Mid America) announced today that the company has been named a top mortgage workplace by two industry trade publications. In addition to garnering Top Mortgage Workplace honors by Mortgage Professional America (MPA), Mid America was also named a Top Mortgage Employer by National Mortgage Professional (NMP) in the magazine's January issue.

TRK Connection Named a 2019 Ellie Mae Experience Sponsor and Exhibitor

SALT LAKE CITY, Utah, March 8, 2019 (SEND2PRESS NEWSWIRE) -- TRK Connection, a leading provider of mortgage quality control (QC) and origination management solutions, announced today it is a sponsor and exhibitor at Ellie Mae Experience 2019. The annual conference will be held March 10-13, 2019 at Moscone West in San Francisco, California.

Anow integrates Veros PATHWAY and VeroSELECT to appraisals submitted by mortgage lenders

RED DEER, Alberta, March 7, 2019 (SEND2PRESS NEWSWIRE) -- Anow, developer of appraisal firm management software that simplifies the way real estate appraisers manage their businesses, today announced appraiser productivity and appraisal quality integrations with Veros Real Estate Solutions (Veros(r)), a leading developer of enterprise risk management, collateral valuation and predictive analytics services.

Simplifile Now E-recording in 1,900 U.S. Counties Nationwide for Q1-2019

PROVO, Utah, March 7, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that Logan County, Illinois, is the 1,900th jurisdiction to join Simplifile's e-recording network.

LBA Ware Named Ellie Mae Experience 2019 Exhibitor

MACON, Ga., March 6, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that it will exhibit at Ellie Mae Experience 2019, which will be held March 10-13, 2019, at Moscone West in San Francisco, California. This year's conference theme, "Driving Innovation Home," encourages attendees to learn about the latest technologies defining the mortgage industry.

FormFree to Help Kick Off Ellie Mae Experience 2019 as Welcome Reception Sponsor and Exhibitor

ATHENS, Ga., March 6, 2019 (SEND2PRESS NEWSWIRE) -- FormFree(R) announced it will help kick off Ellie Mae's (NYSE: ELLI) annual user conference, Ellie Mae Experience 2019, as a sponsor of the event's welcome reception and "wine tasting tour" on Monday, March 11. Ellie Mae Experience 2019 takes place March 10-13 at the Moscone Center in San Francisco.

TRK Connection Hires Chris Bruner as SVP National Sales

SALT LAKE CITY, Utah, March 4, 2019 (SEND2PRESS NEWSWIRE) -- TRK Connection (TRK), a leading provider of mortgage quality control (QC) and origination management solutions, announced today it has hired Chris Bruner, CMB, AMP, as Senior Vice President of National Sales.

Matic Obtains Service Organization Control (SOC) 2 Type II Certification

COLUMBUS, Ohio, Feb. 28, 2019 (SEND2PRESS NEWSWIRE) -- Matic, the digital homeowners insurance marketplace built for mortgage servicers and lenders, announced that it has successfully completed a Service Organization Control (SOC) 2 Type II audit. Conducted by IS Partners, LLC, a globally recognized certified public accounting firm, the audit verifies that Matic's information security practices.

IDS Makes National Mortgage Professional’s Inaugural 2019 List of Top Mortgage Workplaces

SALT LAKE CITY, Utah, Feb. 28, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it has been named to National Mortgage Professional magazine's inaugural list of Top Mortgage Employers in the Service Providers category. IDS was one of only 10 service providers to be recognized on this year's list.

Major Utah Title Insurance Agency Cottonwood Title Selects SafeWire from SafeChain

COLUMBUS, Ohio, Feb. 26, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today that Cottonwood Title Insurance Agency, Inc., one of the largest independent title agencies in Utah, has adopted SafeWire(TM) to protect the wire transactions facilitated by its agents across the Wasatch Front.

TRK Connection Announces Enhanced Integration with Ellie Mae Encompass

SALT LAKE CITY, Utah, Feb. 25, 2019 (SEND2PRESS NEWSWIRE) -- TRK Connection (TRK), a leading provider of mortgage quality control (QC) and origination management solutions, announced that its flagship mortgage QC audit platform Insight Risk & Defect Management (RDM) is now available through the Ellie Mae Encompass Digital Lending Platform via Ellie Mae's Encompass Partner Connect APIs.

National Mortgage Professional Mag Names United Fidelity Funding Corp. a 2019 Top Mortgage Employer

KANSAS CITY, Mo., Feb. 22, 2019 (SEND2PRESS NEWSWIRE) -- United Fidelity Funding Corp. (UFF), a rapidly growing national mortgage banker, announced that it was designated a Top Mortgage Employer for 2019 by National Mortgage Professional (NMP) magazine.

Quandis Adds Automated Monitoring to its Military Search Service for SCRA Compliance

RANCHO SANTA MARGARITA, Calif., Feb. 20, 2019 (SEND2PRESS NEWSWIRE) -- Quandis, Inc., a leading default management mortgage technology provider, announced that it incorporated functionality into its Military Search service that empowers clients with the ability to easily customize real-time monitoring data analysis that is more explicit and inclusive in nature, returning the most granular searches in the industry for active military personnel along with detailed reporting.

FormFree Honored as Top Mortgage Workplace by Mortgage Professional America Magazine

ATHENS, Ga., Feb. 21, 2019 (SEND2PRESS NEWSWIRE) -- FormFree has been named to Mortgage Professional America's (MPA) list of Top Mortgage Workplaces. MPA's inaugural awards program recognized 32 of the best employers in the mortgage industry, which included a mix of lenders, brokers, appraisal management companies and technology vendors.

LBA Ware’s Outstanding Corporate Culture Garners the Firm Multiple Honors as a Top Mortgage Workplace

MACON, Ga., Feb. 21, 2018 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that the company has been named a top mortgage workplace by two industry trade publications.

Simplifile Named a Top Mortgage Workplace by Mortgage Professional America

PROVO, Utah, Feb. 21, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that it has garnered a spot on the inaugural Top Mortgage Workplace list, sponsored by industry trade publication Mortgage Professional America (MPA).

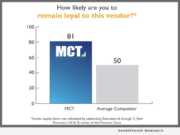

MCT Trading Scores High Marks in Overall Satisfaction, Lender Loyalty, and Functionality Effectiveness According to Recent Study by STRATMOR Group

SAN DIEGO, Calif., Feb. 19, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage Capital Trading (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced that the 2018 STRATMOR Technology Insight Study rated MCT as the leader in overall satisfaction, lender loyalty, and functionality effectiveness in the production pipeline hedging industry, according to survey respondents.

OpenClose Integrates its LOS with Continuity Programs’ Mortgage CRM

WEST PALM BEACH, Fla., Feb. 21, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced it has completed an integration with Continuity Programs, Inc.'s cloud-based MyCRMDashboard.com customer relationship management (CRM) software.

Mid America Mortgage CEO Jeff Bode Named 2019 Top 25 Industry Leader by MReport

ADDISON, Texas, Feb. 15, 2019 (SEND2PRESS NEWSWIRE) -- Mid America Mortgage, Inc. announced today that CEO Jeff Bode has been named one of MReport's 2019 "The Top 25 Industry Leaders & Influencers." As MReport Editor-in-Chief Rachel Williams noted in the December 6 announcement regarding the awards program, "MReport's Top 25 Industry Leaders list celebrates individuals whose unique perspectives are strengthening the industry's future."

The MReport Names DocMagic CEO Dominic Iannitti a 2019 ‘Top 25 Industry Leader and Influencer’

TORRANCE, Calif., Feb. 14, 2019 (SEND2PRESS NEWSWIRE) -- DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance and comprehensive eMortgage services, announced that MReport magazine has named company president and CEO Dominic Iannitti one of its Top 25 Industry Leaders & Influencers for 2019.

AFN Deploys CompenSafe to Provide Real-Time Reporting of Loan Originator Compensation

MACON, Ga., Feb. 8, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated incentive compensation and sales performance management platform for mortgage lenders, announced today that American Financial Network, Inc. (AFN), a mortgage lender with more than 125 branches nationwide, has adopted CompenSafe to manage loan originator (LO) compensation plans with greater efficiency and transparency.

IDS, Inc. Successful 2018 with New Mortgage Doc Prep System Functionality, LOS Integrations, and Individual Honors

SALT LAKE CITY, Utah, Feb. 8, 2019 (SEND2PRESS NEWSWIRE) -- Mortgage document preparation vendor International Document Services, Inc. (IDS), announced it completed 139 updates to its flagship mortgage document preparation platform idsDoc in 2018. These updates were made in response to regulatory, client and investor directives.

American Society of Appraisers partners with Anow to give real property appraisers a competitive edge

RED DEER, Alberta and WASHINGTON, D.C., Feb. 7, 2019 (SEND2PRESS NEWSWIRE) -- Anow, creator of the leading software for real estate appraisal offices, today announced a partnership with the American Society of Appraisers (ASA) that gives members a significant discount off Anow's core appraisal office management platform and early access to the tech firm's cutting-edge products currently in development.

ACES Risk Management (ARMCO) Named a ‘Top 100 Mortgage Employer’ by National Mortgage Pro Magazine for Third Consecutive Year

POMPANO BEACH, Fla., Feb. 5, 2019 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced that it was named among National Mortgage Professional (NMP) magazine's annual Top 100 Mortgage Employers list for 2019. This is the third consecutive year the company has been recognized with this distinction.

SafeChain Collaborates with Accuity to Secure U.S. Real Estate Wire Transfers

COLUMBUS, Ohio, and EVANSTON, Ill., Feb. 4, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today that it has integrated bank data from Accuity, the leading provider of financial crime compliance, payments and Know Your Customer (KYC) solutions, to enhance the security of real estate transactions.

LBA Ware Adds Real-Time Mortgage Compensation Push Notifications to SimpleNexus Mobile Originator App

MACON, Ga., Jan. 31, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that it has completed a partial integration of its compensation platform CompenSafe(TM) with SimpleNexus's enterprise digital mortgage solution. As a result, LOs will be able to receive real-time push notifications on calculated loan commissions directly through the SimpleNexus app.

National Mortgage Professional Mag Designates OpenClose a Top Mortgage Employer for the Third Consecutive Year

WEST PALM BEACH, Fla., Jan. 30, 2019 (SEND2PRESS NEWSWIRE) -- OpenClose, an industry-leading multi-channel loan origination system (LOS) and digital mortgage fintech provider, announced that it was selected as a 2019 Top Mortgage Employer by National Mortgage Professional (NMP) magazine for the third straight year.

Nevada Now E-recording Statewide with Simplifile’s Real Estate Technology

PROVO, Utah and CARSON City, Nev., Jan. 30, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that Mineral County, Nev., has adopted its e-recording service.

FormFree President Faith Schwartz to Kick Off NEXT Mortgage Conference with Address on Succeeding in a Transitional Mortgage Market

ATHENS, Ga., Jan. 30, 2019 (SEND2PRESS NEWSWIRE) -- FormFree today announced that Acting President Faith Schwartz will kick off the upcoming NEXT mortgage technology summit for women, which will take place February 7-8, 2019, at Hotel ZaZa in Dallas, Texas. Schwartz's address, "Winning in a Transitional Market," will take place on Thursday, February 7, from 8:20-8:50 a.m. CT on the event's main stage.

Cloudvirga’s Kyle Kamrooz named a 2019 top mortgage professional under 40

IRVINE, Calif., Jan. 29, 2019 (SEND2PRESS NEWSWIRE) -- Cloudvirga, a leading provider of digital mortgage software, today announced that company Co-founder Kyle Kamrooz has been named to National Mortgage Professional (NMP) magazine's list of the 40 most influential mortgage professionals under 40 for the second year in a row.

Providence Title in Texas Expands Use of SafeChain’s SafeWire to All 25 Offices

COLUMBUS, Ohio, Jan. 29, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today that Providence Title, one of the largest independent title companies in Texas, has expanded its deployment of SafeWire to include all 25 offices throughout the state. Moving forward, Providence Title's network of agents will use SafeWire to verify the identities of transaction participants, authenticate bank account ownership as well as securely store and transmit wiring instructions.

NotaryCam Helps East Texas Title Complete First Remote Online Closing

NEWPORT BEACH, Calif., Jan. 29, 2019 (SEND2PRESS NEWSWIRE) -- NotaryCam, the pioneering and market leader in remote online notarization and mortgage eClosing solutions, today announced that East Texas Title has executed its first remote online closing (ROC(TM)) in Texas since the state's remote online notarization law went into effect. The transaction, which was executed using NotaryCam's eClose360 eClosing platform, was performed on behalf of a couple currently located in Colorado and selling their property in Longview, Texas.

Digital mortgage firm Cloudvirga closes 2018 with customers producing nearly $200B in loan volume

IRVINE, Calif., Jan. 24, 2019 (SEND2PRESS NEWSWIRE) -- Cloudvirga, a leading provider of digital mortgage software, closed the books on 2018 with a 54 percent year-over-year increase in mortgage loan volume processed through its intelligent Mortgage Platform(TM). The strong 2018 results topped a long list of achievements.

Matic Helps Servicers Shave Nearly 6% Off Homeowners’ Monthly Mortgage Costs in 2018

COLUMBUS, Ohio, Jan. 24, 2019 (SEND2PRESS NEWSWIRE) -- Matic, the digital homeowners insurance marketplace built for mortgage servicers and lenders, reduced homeowners' monthly mortgage costs an average of 5.5 percent in 2018 by delivering average per-household homeowners insurance savings of $517. The announcement comes on the heels of a year marked by rapid growth for Matic, which helped homeowners identify $124 million in savings over the course of quoting homeowners insurance for over $180 billion worth of residential real estate.

Business Association of Real Estate Appraisers partners with Anow to empower appraisal firms in Canada

RED DEER, Alberta, Jan. 22, 2019 (SEND2PRESS NEWSWIRE) -- Anow, the appraisal firm management software developer that simplifies the way real estate appraisers manage their businesses, today announced a partnership that makes its powerful appraisal technology platform available to members of the Business Association of Real Estate Appraisers (BAREA).

FormFree Builds on Its Success in 2018 with New Products and Industry Partnerships, Including Freddie Mac

ATHENS, Ga., Jan. 22, 2019 (SEND2PRESS NEWSWIRE) -- After a banner 2018 that included new partnerships, a product launch and several industry accolades, automated verification provider FormFree anticipates continued growth and innovation in 2019 thanks in part to an expanded focus on serving the needs of independent mortgage brokers.

Transformational Mortgage Solutions Names Michael Barrett a Mortgage Executive Consultant

AUSTIN, Texas, Jan. 22, 2019 (SEND2PRESS NEWSWIRE) -- Leading mortgage industry management consulting firm Austin, Texas-based Transformational Mortgage Solutions (TMS), today announced that it has brought on Michael Barrett as mortgage executive consultant. In this role, Barrett will apply his more than 17-years of mortgage business and product development expertise to helping TMS clients improve process efficiencies, execute digital mortgage transformation strategies and expand profit margins.

Simplifile Welcomes 46 Midwest, West Jurisdictions to E-recording Network

PROVO, Utah, Jan. 18, 2019 (SEND2PRESS NEWSWIRE) -- Simplifile, a leading provider of real estate document collaboration and recording technologies for lenders, settlement agents and counties, today announced that 46 additional recording jurisdictions located in 13 states throughout the Midwest and Western U.S. have joined Simplifile's e-recording network.

LenderCity Chooses FinKube ELSA AI-Powered Virtual Assistant Fintech Solution

DALLAS, Texas, Jan. 18, 2019 (SEND2PRESS NEWSWIRE) -- FinKube, a company that provides AI-powered Platform-as-a-Service solutions for a range of industries, announced today that St. Louis-based LenderCity has successfully deployed ELSA, FinKube's Electronic Loan Services Assistant. The mortgage industry's first chatbot is already interacting with prospective borrowers on the LenderCity website.

SafeChain Digitizes Property Deed Transfer for Perry County, Ohio

COLUMBUS, Ohio, Jan. 15, 2019 (SEND2PRESS NEWSWIRE) -- SafeChain, the industry leader in wire fraud prevention software and blockchain implementation for land title, announced today it has completed the digital conversion of Perry County, Ohio's deed transfer and conveyance process between the engineer and auditor. Beginning January 7, the Perry County Engineer's office will be able to digitize property deeds before the inspection and mapping process.

Anow Closes 2018 with 110% Year-over-Year Increase in Orders Processed Through Its Appraisal Management Technology

RED DEER, Alberta, Jan. 15, 2019 (SEND2PRESS NEWSWIRE) -- Digital appraisal management software developer Anow reported a record 110 percent year-over-year increase in appraisal orders processed through its core appraisal office management platform in 2018 despite an industry-wide, market-driven drop in orders per customer. The announcement follows a year punctuated by major product launches.

LBA Ware CEO to Discuss Loan Originator Compensation Trends in Today’s Market at 2019 Independent Mortgage Bankers Conference

MACON, Ga., Jan. 15, 2019 (SEND2PRESS NEWSWIRE) -- LBA Ware, provider of the leading automated compensation and sales performance management platform for mortgage lenders, today announced that its Founder and CEO Lori Brewer will be a panelist at the Mortgage Bankers Association's (MBA) 2019 Independent Mortgage Bankers (IMB) Conference, which will be held January 28-31 at the Hyatt Regency San Francisco.

ARMCO Launches 2019 ARMCO CARES Employee Donation Matching Program

POMPANO BEACH, Fla., Jan. 10, 2019 (SEND2PRESS NEWSWIRE) -- ACES Risk Management (ARMCO), the leading provider of enterprise financial risk management solutions, announced the launch of ARMCO CARES, the company's employee matching gift program.

The Cooksey Team Achieves 35% Increase in Profitability in 2018 Despite Overall Mortgage Market Decline

DALLAS, Texas, Jan. 10, 2019 (SEND2PRESS NEWSWIRE) -- The Cooksey Team, a top-producing retail branch of Mid America Mortgage, Inc., announced today it has achieved year-over-year growth in volume and profitability for the sixth year running. In 2018, The Cooksey Team increased its overall volume by 27 percent over the previous year and increased the number of loan units closed by 28 percent.

Former Black Knight exec Dan Sogorka joins Cloudvirga as chief revenue officer

IRVINE, Calif., Jan. 10, 2019 (SEND2PRESS NEWSWIRE) - Cloudvirga(TM), a leading provider of digital mortgage software, today announced the appointments of Dan Sogorka as chief revenue officer and Kelly Kucera as senior vice president of marketing. Sogorka, a seasoned mortgage technology executive, will drive Cloudvirga's continued revenue growth and oversee the firm's sales and marketing strategy with the help of veteran cloud technology marketer Kucera.

Triserv Becomes a Preferred Partner of The Mortgage Collaborative (TMC)

ROSWELL, Ga., Jan. 9, 2019 (SEND2PRESS NEWSWIRE) -- Triserv, a national appraisal management company (AMC), is proud to announce a strategic partnership with The Mortgage Collaborative to provide appraisal management services to the organization's growing lender member network.