Tag: DepthPR

Katie Smith of FirstClose named to 2025 HousingWire Woman of Influence list

AUSTIN, Texas /Massachusetts Newswire: -- FirstClose™, Inc., a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, announced its Senior Vice President of Human Resources Katie Smith has been named a 2025 HousingWire Woman of Influence. The national award recognizes her exceptional leadership, commitment to company culture and impact on the fintech and mortgage lending industry.

The Big Picture July 2025 conversations engage experts in mortgage market analytics, housing finance and home ownership growth strategies

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, has unveiled its July guest lineup featuring five impressive leaders who will explore the power of analytics, interpret public policy signals, unpack the barriers to home ownership and deliver pragmatic capital markets perspective. Co-hosted by mortgage business consultant and executive coach Rich Swerbinsky and capital markets authority Rob Chrisman, author of the widely read Chrisman Commentary newsletter, the webcast delivers timely, thought-provoking conversations with mortgage professionals, innovators and thought leaders.

Melinda Lesinski of Class Valuation named to 2025 Women of Influence list by HousingWire

TROY, Mich. /Massachusetts Newswire: -- Class Valuation, a leading real estate appraisal management company (AMC), announced today that Executive Vice President, Head of Operations Melinda (Mindy) Lesinski has been named to HousingWire's 2025 Women of Influence list. HousingWire's Women of Influence program was launched in 2010 to recognize women making notable contributions to both their businesses and the industry at large, with a specific focus on contributions during the most recent 12 months.

Dark Matter achieves UCDP integration, driving appraisal innovation for mortgage technology industry

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced it has established an integration with Uniform Collateral Data Portal® (UCDP®), a single portal jointly maintained by Fannie Mae and Freddie Mac (the GSEs). This expansion positions Dark Matter as an early adopter of the technology needed to support the Uniform Appraisal Dataset (UAD) 3.6 and Forms Redesign initiative.

Sean Dugan, CEO of Dark Matter Technologies, named to Inman’s 2025 Best of Finance list

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced its CEO, Sean Dugan, has been named to Inman's 2025 Best of Finance list. Now in its third year, the award is a prestigious industry recognition honoring professionals in the mortgage and financial services sectors who demonstrate exceptional innovation, influence and impact on the residential real estate ecosystem.

Shmulik Fishman, Argyle CEO, named to the Inman 2025 Best of Finance list for second consecutive year

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a service provider automating income, employment and asset verifications for some of the largest lenders in the United States, today announced that its founder and CEO Shmulik Fishman has been named one of Inman's 2025 Best of Finance, his second consecutive appearance on the list. Inman's editorial team hand-selects distinguished professionals for their role in driving the mortgage and financial services industries forward through leadership, exceptional service and commitment to innovation.

Cloudvirga CEO Maria Moskver recognized for driving innovation and helping lenders create stronger borrower relationships

IRVINE, Calif. /Massachusetts Newswire: -- Cloudvirga, a leading provider of digital mortgage point-of-sale platforms, today announced that CEO Maria Moskver has been named to Inman's 2025 Best of Finance list. Moskver has earned a place on the list every year since its creation in 2023, making this her third consecutive recognition.

Argyle’s verification platform expanded to include verification of assets powered by Mastercard open finance technology

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a service provider automating income and employment verifications for some of the largest lenders and tenant screening platforms in the United States, today announced the availability of verification of assets powered by Mastercard's open finance technology. The expanded offering enables lenders to confirm borrowers' balances, cash-to-close and cash-flow history alongside income and employment.

Floify’s Sofia Rossato named to 2025 Best of Finance list

BOULDER, Colo. /Massachusetts Newswire: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that Sofia Rossato, its president and general manager, has been named a recipient of Inman's 2025 Best of Finance award. Unlike many awards where leaders are nominated by their companies, this award is managed entirely by the Inman editorial team to recognize leaders driving meaningful change in the lending industry independently.

Class Valuation announces the launch of Class Valuation Analysis (CVA) Solution

TROY, Mich. /Massachusetts Newswire: -- Class Valuation, a leading real estate appraisal management company (AMC), announced today the launch of Class Valuation Analysis (CVA), a next-generation appraisal review solution engineered to bring greater transparency, compliance and confidence to residential property valuations.

Andy Clonts joins SBA (Strategic Benefits Advisors) as director and senior benefits consultant

ATLANTA, Ga. /Massachusetts Newswire: -- Strategic Benefits Advisors, Inc. (SBA) today announced the appointment of Andy Clonts as director and senior benefits consultant. In this role, Clonts will be responsible for driving business growth while leveraging his extensive experience in employee benefits strategy, healthcare navigation and client engagement to deliver tailored solutions to SBA's expanding roster of clients.

THE SIP PODCAST from The Mortgage Collaborative Delivers Industry Insights and Peer Collaboration

SAN DIEGO, Calif. /Massachusetts Newswire: -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced the launch of its new weekly podcast, "The Sip," designed to give mortgage professionals direct access to peers solving the same challenges they face every day. From tech adoption and compliance pressure to margin management, the 30-minute series delivers real-world strategies shared by lenders, for lenders-streamed live every Tuesday on LinkedIn.

Argyle’s enhanced integration with nCino earns PROGRESS in Lending 2025 Connections award

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a service provider automating income and employment verifications for some of the largest lenders in the United States, today announced that its integration with nCino, a leading provider of intelligent, best-in-class banking and mortgage solutions, has been honored with PROGRESS in Lending's 2025 Connections Award. The award celebrates transformative partnerships and integrations reshaping the mortgage industry through greater efficiency, innovation and collaboration.

Sofia Rossato of Floify named to the 2025 Progress in Lending most powerful women in fintech list

BOULDER, Colo. /Massachusetts Newswire: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that its president and general manager, Sofia Rossato, has received the 2025 Most Powerful Women in FinTech award from Progress in Lending (PIL). The PIL award is a prestigious, annual recognition celebrating professionals who are innovating, optimizing processes and shaping the future of mortgage finance and broader financial services.

Dark Matter adds side-by-side results comparison and automated, rules-based reviews to dual AUS feature in Empower LOS

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced enhancements to the dual automated underwriting system (AUS) submission feature within the Empower® loan origination system (LOS). When users submit loan data simultaneously to the AUS for both Freddie Mac and Fannie Mae (the government-sponsored enterprises, or GSEs), the Empower LOS will now display the GSEs' respective AUS findings side by side along with rules-based loan recommendations powered by the AIVA® Rules engine.

Optimal Blue Releases May Data Findings, Announces Expansion of Monthly Report for More Comprehensive 2025 Lender Profitability Insights

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today released the May 2025 edition of its now-expanded Market Advantage mortgage data report, which features newly added borrower profile and capital market datasets for a more comprehensive picture of early-stage mortgage activity and loan profitability. The enhancements come at a critical time for mortgage lenders navigating heightened interest rates, tighter margins, increased volatility and deepening affordability challenges.

iEmergent honored with a PROGRESS in Lending 2025 Connections Award

DES MOINES, Iowa /Massachusetts Newswire: -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced its selection as a recipient of PROGRESS in Lending's 2025 Connections Award. The recognition honors iEmergent's instrumental role in CONVERGENCE Columbus, a cross-sector initiative led by the Mortgage Bankers Association (MBA) to close the racial homeownership gap in Central Ohio.

PROGRESS in Lending honors Cloudvirga with 2025 Connections Award

IRVINE, Calif. /Massachusetts Newswire: -- Cloudvirga, a leading provider of digital mortgage point-of-sale platforms, today announced it has been named a recipient of PROGRESS in Lending's 2025 Connections Award. The award honors strategic partnerships and integrations that are reshaping the mortgage industry by advancing efficiency, innovation, and collaboration.

Optimal Blue Launches New Lead Generation Tool for Mortgage Loan Originators

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today announced a new product that helps originators efficiently track and identify refinance opportunities so they can reengage borrowers with eligible refinance options at the right time. Available to Optimal Blue PPE users, Capture for Originators dramatically reduces the manual effort loan officers currently spend evaluating refinance potential by automatically analyzing entire portfolios each month and putting recapture opportunities directly into originators' hands.

ACES Champions a Commitment to Lending Excellence at ACES ENGAGE 2025

DENVER, Colo. /Massachusetts Newswire: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced official launch of its "I Stand for Quality" movement during its annual ACES ENGAGE conference, held May 18-20, 2025 at The Broadmoor Hotel in Colorado Springs.

Informative Research VP Marketing, Craig Leabig, Named a HousingWire 2025 Marketing Leader

GARDEN GROVE, Calif. /Massachusetts Newswire: -- nformative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, today announced that Senior Vice President of Marketing Craig Leabig has been named a 2025 HousingWire Marketing Leader. This year's award honors 55 professionals reshaping how mortgage and real estate companies engage prospects and accelerate growth. Leabig's strategic leadership has transformed Informative Research's marketing into an engine of innovation and measurable results.

Dark Matter announces comprehensive eClosing integration for its NOVA loan origination system (LOS)

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, announced today that the NOVA loan origination system (LOS) platform now features a comprehensive integration to the eClosing capabilities powered by the Wolters Kluwer eOriginal® ClosingCenter. Designed to improve the mortgage closing process, eClose will help lenders reduce time-to-close, realize cost savings and provide a better borrower experience while also enabling secondary market activities.

Courtney Dodd of Floify named to the 2025 HousingWire Marketing Leaders list for a second year in a row

BOULDER, Colo. /Massachusetts Newswire: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that Courtney Dodd, head of marketing, has been named to HousingWire's prestigious Marketing Leaders list for 2025. She was also a 2024 Marketing Leaders recipient. The Marketing Leaders award honors the outstanding accomplishments of mortgage and real estate marketing executives who are the visionaries behind the strategies, campaigns and branding efforts that push the industry forward.

Mortgage Wholesale Veteran Tony Catanese named Regional Sales Manager to Lead East Coast Expansion at Click n’ Close

ADDISON, Texas /Massachusetts Newswire: -- Click n' Close, a multi-state mortgage lender and innovator in third-party origination (TPO), announced Thursday that Tony Catanese has joined the company as regional sales manager. In this role, Catanese will lead the company's wholesale and non-delegated expansion across the East Coast, focusing on building and developing a high-performing sales team.

Friday Harbor’s AI-powered condition engine to deliver cleaner, audit-ready mortgage files

SEATTLE, Wash. /Massachusetts Newswire: -- Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the launch of a retooled condition engine that automatically generates actionable underwriting conditions based on borrower source documents and loan guidelines.

The Big Picture June 2025 conversations go deep on homeownership access, growth and risk

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, has unveiled its June guest lineup featuring four standout leaders whose insights are redefining housing access, real estate strategy and economic understanding. Co-hosted by mortgage business consultant and executive coach Rich Swerbinsky and capital markets authority Rob Chrisman, author of the widely read Chrisman Commentary newsletter, the webcast delivers timely, thought-provoking conversations with mortgage professionals, innovators and thought leaders.

To enhance mortgage servicing for its members, SESLOC Credit Union partners with Dovenmuehle Mortgage

LAKE ZURICH, Ill. /Massachusetts Newswire: -- Dovenmuehle Mortgage, Inc. (DMI), a leading mortgage subservicing company, today announced a partnership with SESLOC Credit Union, a not-for-profit financial cooperative serving central and coastal California communities. Under the agreement, DMI will subservice SESLOC's mortgage loan portfolio, supporting the credit union's expansion into government-sponsored enterprise (GSE) lending and servicing, allowing it to scale mortgage operations efficiently while preserving superior member service.

Argyle integration with Byte Software is bringing real-time VOIE to Byte LOS customers

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, today announced a new integration with Byte Software's loan origination system (LOS). The integration enables lenders to access Argyle's real-time verification of income and employment (VOIE) services directly within the Byte platform, ensuring verification happens when and where it's needed to improve loan quality and keep loans moving forward.

New integration enhances lender efficiency by seamlessly connecting Cloudvirga’s POS with Encompass Docs Solution

IRVINE, Calif. /Massachusetts Newswire: -- Cloudvirga, a Stewart-owned provider of digital point-of-sale platforms for lenders, today announced a new integration using the latest API framework for mortgage technology from Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure. Available via the Marketplace in the ICE digital lending platform, the integration expands the document provider options available to Cloudvirga customers and enhances lender efficiency and compliance by streamlining the generation, delivery and management of initial and revised disclosures.

Optimal Blue no-cost, AI-powered assistant is built for executive decision-makers seeking fast answers to complex profitability questions

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today announced that Ask Obi, an AI-powered assistant designed to help mortgage lending executives extract real-time insights from across Optimal Blue's capital markets platform, is now generally available to all PPE clients. Introduced at the company's inaugural user conference in February and refined through beta testing with select clients, Ask Obi provides executives with fast answers to complex profitability questions at no additional cost.

To Automate Income Validation, Informative Research Integrates AccountChek with Halcyon

GARDEN GROVE, Calif. /Massachusetts Newswire: -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, today announced a strategic integration with Halcyon, a fintech innovator revolutionizing income verification through real-time access to IRS tax transcript data. This integration delivers verification of employment and income (VOE/I) reports-including payroll and paystub data-directly into Halcyon's income calculator, enabling faster, more automated income assessments.

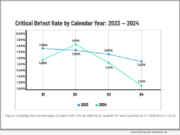

ACES Mortgage QC Industry Trends Report for Q4/CY 2024 finds quarterly defect rate falls to 1.16% as annual loan quality improves

DENVER, Colo. /Massachusetts Newswire: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and calendar year (CY) of 2024. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

ACES Quality Management Named a ‘Best Places to Work’ for 2025 in Financial Tech

DENVER, Colo. /Massachusetts Newswire: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced that it has been named one of the 2025 Best Places to Work in Financial Technology. The annual awards program recognizes the leading companies in the financial technology sector that foster exceptional workplace experiences and support employee engagement satisfaction.

Argyle, has announced the debut of its integration with Encompass Consumer Connect

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a service provider automating income and employment verifications for some of the largest lenders in the United States, today announced the debut of its integration with Encompass® Consumer Connect™, a digital mortgage point-of-sale solution from ICE Mortgage Technology®, part of Intercontinental Exchange (NYSE: ICE). In addition, Argyle announced the release of significant upgrades to its existing integration with ICE Mortgage Technology's flagship Encompass® loan origination system.

Optimal Blue’s April 2025 Market Advantage report shows stronger purchase activity, a shifting loan mix, and signs of investor caution

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today released its April 2025 Market Advantage mortgage data report showing total loan lock volume rose 3.2% month-over-month (MoM) as the spring homebuying season progressed, with purchase locks up 7.5% despite ongoing economic pressures.

Argyle integration with Tidalwave to give lenders faster, more efficient VOIE while improving the borrower experience

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a service provider automating income and employment verifications for some of the largest lenders in the United States, today announced its integration with Tidalwave, an agentic AI mortgage point-of-sale (POS) platform. The integration embeds Argyle's verification of income and employment (VOIE) solution directly into Tidalwave's borrower workflow, eliminating manual steps and accelerating loan origination as lenders prepare for a more active housing market.

2025/Q1 Homebuyer Intelligence Report from LenderLogix Shows Early 2025 Mortgage Market Momentum, Stronger Loan Engagement

BUFFALO, N.Y. /Massachusetts Newswire: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the first quarter (Q1) of 2025.

The Mortgage Collaborative: Lifted by Collaboration During Extended Period of Margin Compression, Regulatory Chaos, and Tech Transformation

SAN DIEGO, Calif. /Massachusetts Newswire: -- Navigating a prolonged era of complexity marked by compressed margins, fierce recruiting wars, regulatory uncertainty, and rapid technological transformation, mortgage lenders find guidance and support in collaboration, according to The Mortgage Collaborative (TMC), an industry-leading organization for mortgage lenders of every variety.

AI-Powered Originator Assistant launched by Optimal Blue to Help Originators Present Best Possible Loan Options to Borrowers

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today announced the general availability of Originator Assistant, a powerful addition to the Optimal Blue PPE. Leveraging generative AI, Originator Assistant eliminates human bias in the loan structuring process and helps originators identify all options for a borrower, providing more ways to help consumers realize the American dream of homeownership.

Cloudvirga announces launche of TROPOS, its modern borrower portal built for the future of digital lending

IRVINE, Calif. /Massachusetts Newswire: -- Cloudvirga, a Stewart-owned provider of digital point-of-sale platforms for lenders, today announced the launch of Tropos, a next-generation borrower portal that will empower lenders to deliver personalized, intuitive digital experiences from initial application through clear-to-close. Designed with the flexibility to support a variety of consumer lending products, Tropos enhances Cloudvirga's POS ecosystem with a modular, customer-first solution that helps lenders drive engagement, reduce time to close and establish lasting borrower relationships.

Envoy Mortgage will implement Down Payment Resource’s suite of software tools across its national footprint

ATLANTA, Ga. /Massachusetts Newswire: -- Down Payment Resource (DPR), the housing industry's leading provider of technology that connects homebuyers with homebuyer assistance programs, today announced that Envoy Mortgage (Envoy) will implement DPR's suite of software tools across its national footprint. The move follows a successful pilot and reflects Envoy's commitment to expanding down payment assistance (DPA) offerings while maintaining operational efficiency and reducing repurchase risk.

iEmergent has released its analysis of 2024 Home Mortgage Disclosure Act (HMDA) data

DES MOINES, Iowa /Massachusetts Newswire: -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, has released its analysis of 2024 Home Mortgage Disclosure Act (HMDA) data in Mortgage MarketSmart. The insights, shared by iEmergent CEO Laird Nossuli, highlight a modest market recovery from 2023 alongside deepening disparities in borrower outcomes and a reshuffling of lender dynamics.

LenderLogix LiteSpeed Point-of-Sale Selected by Victorian Finance

BUFFALO, N.Y. /Massachusetts Newswire: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced that Victorian Finance, an independent mortgage lending company, has implemented LiteSpeed™ to replace its legacy point-of-sale (POS) system. Victorian Finance will use LiteSpeed to provide borrowers with an automated, digital-first mortgage experience.

Dark Matter Technologies launches Developer Portal, opening the Empower LOS to accelerate third-party development

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today unveiled a new Developer Portal during its second annual Horizon user conference. The Developer Portal marks a significant evolution for the Empower® loan origination system (LOS), moving from API access to a fully open API ecosystem.

43 new assistance programs were added during the first quarter of 2025, says Down Payment Resource’s Q1 2025 HPI Report

ATLANTA, Ga. /Massachusetts Newswire: -- Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q1 2025 Homeownership Program Index (HPI) report. The report saw the number of entities offering homebuyer assistance programs increase by 55 year-over-year (YoY). The number of programs increased by 43 during the first quarter, bringing the total number of available programs to 2,509.

AMC industry veterans Jim Bannister and Scott Shaw join Class Valuation

TROY, Mich. /Massachusetts Newswire: -- Class Valuation, a leading real estate appraisal management company (AMC), announced today the expansion of its national sales team with the appointments of Jim Bannister and Scott Shaw as senior sales executives. Together, they bring over 45 years of combined experience in mortgage lending, financial services and technology to the company's expanding leadership.

Podcast: iEmergent’s Nossuli duo to unpack SPCP fallout and early HMDA trends on The Big Picture

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, this week features iEmergent CEO Laird Nossuli and COO Bernard Nossuli. The husband-and-wife leadership team will join co-hosts Rich Swerbinsky, mortgage business consultant and executive coach, and Rob Chrisman, editor-in-chief of the widely followed Chrisman Commentary newsletter, to explore the critical role of special purpose credit programs (SPCPs) in expanding credit access and building sustainable business growth.

AI Fintech Firm, Friday Harbor Inc., raises $6M to help community mortgage lenders match the speed and efficiency of finance industry...

SEATTLE, Wash. /Massachusetts Newswire: -- Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced the completion of a $6 million seed round. The round was led by Abstract Ventures, a San Francisco-based venture firm with $1.5 billion in assets under management and a track record of backing breakout companies including Rippling, xAI, Hebbia, Brigit and Hippo (NYSE: HIPO) and Mischief, an early-stage VC fund co-founded by Plaid CEO Zach Perret.

To accelerate its innovation and data strategy, Class Valuation names Chris Flynn chief data officer

TROY, Mich. /Massachusetts Newswire: -- Class Valuation, a leading real estate appraisal management company (AMC), announced today that Chris Flynn has joined its leadership team as chief data officer effective April 1. In his new role, Flynn will lead Class Valuation's enterprise data strategy, overseeing the development of scalable analytics, AI capabilities and automation to improve valuation accuracy, speed and transparency.

Tidewater Mortgage Services has replaced its legacy point-of-sale (POS) technology with LiteSpeed

BUFFALO, N.Y. /Massachusetts Newswire: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced Tidewater Mortgage Services (Tidewater), a retail mortgage lending company, has replaced its legacy point-of-sale (POS) technology with LiteSpeed, thus expanding its partnership with the company. In addition to Fee Chaser™, Tidewater will now use LiteSpeed as the point-of-sale to automate mortgage processes and provide borrowers with a digital-first experience.

The Big Picture Webcast: The future of builder-affiliated lending: Jet’s Kelley Hailstone talks strategy

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, this week features Kelley Hailstone, president of Jet Home Loans. Hailstone will join co-hosts Rich Swerbinsky, mortgage business consultant and executive coach, and Rob Chrisman, editor-in-chief of the widely followed Chrisman Commentary newsletter, to discuss how homebuilder-aligned lending models can help lenders scale smartly, differentiate in today's market and better serve new homebuyers.

Click n’ Close (CNC), a multi-state mortgage lender, announces Kim Schenck has joined its Correspondent Lending Sales team

ADDISON, Texas /Massachusetts Newswire: -- Click n' Close (CNC), a multi-state mortgage lender, announced today that Kim Schenck has joined its Correspondent Lending Sales team as Correspondent Manager. In her new role, Schenck will lead the expansion of the company's proprietary down payment assistance (DPA) program, which plays a key role in helping more borrowers achieve homeownership.

Class Valuation announces the strategic acquisition of Appraisal Nation

TROY, Mich. /Massachusetts Newswire: -- Class Valuation, a leading national real estate appraisal management company (AMC), today announced the strategic acquisition of Appraisal Nation, a Cary, North Carolina-based AMC specializing in comprehensive valuation solutions for the private lending market.

Optimal Blue today released its March 2025 Market Advantage mortgage data report

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today released its March 2025 Market Advantage mortgage data report, showing a 24% surge in rate lock volume as early spring buyers returned to the market and homeowners jumped at the chance to refinance into lower rates. While still down 2% on a year-over-year (YoY) basis, purchase volumes were up 21% month-over-month (MoM). Rate-and-term and cash-out refinances jumped 52% and 20% MoM, respectively, together representing 25% of all lock activity.

The Mortgage Collaborative CEO Jodi Hall to spotlight new leadership priorities and industry insights for 2025 on The Big Picture Webcast

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, this week features Jodi Hall, president and CEO of The Mortgage Collaborative (TMC). Hall will join co-hosts Rich Swerbinsky, mortgage business consultant and executive coach, and Rob Chrisman, editor-in-chief of the widely followed Chrisman Commentary newsletter.

The Mortgage Collaborative Expands with New Lender Members and Preferred Partners in 2025

SAN DIEGO, Calif. /Massachusetts Newswire: -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, proudly announces the addition of several new lender members and preferred partners to its growing community. These organizations join TMC's network of industry leaders committed to collaboration, innovation, and operational excellence.

Cloudvirga’s Aaron Heidorn honored as a HousingWire Rising Star for 2025

IRVINE, Calif. /Massachusetts Newswire: -- Cloudvirga, a leading provider of digital mortgage point-of-sale platforms, today announced that Aaron Heidorn, director of software engineering and infrastructure, has been named a 2025 HousingWire Rising Star. The annual award recognizes young professionals who are driving innovation and growth in the housing economy and shaping the future of mortgage and real estate technology.

Dovenmuehle Mortgage Receives New Subordinate Lien Servicer Ranking, Maintains Above Average Primary Servicer Ranking from S&P Global Ratings

LAKE ZURICH, Ill. /Massachusetts Newswire: -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading mortgage subservicing company, today announced that S&P Global Ratings has assigned the company an Above Average ranking as a residential mortgage loan subordinate lien servicer, in addition to reaffirming its Above Average ranking as a residential mortgage loan primary servicer with a stable outlook.

WEBINAR: ‘Not Sold on Diversity? Fine. Let’s Talk About Your Bottom Line’ tackles how lenders can reach underserved markets

DES MOINES, Iowa /Massachusetts Newswire: -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced a provocative new webinar that dares to reframe the diversity conversation through a business lens. Amid growing pushback on diversity, equity and inclusion (DEI) initiatives, iEmergent is doubling down on the importance of inclusive lending to lenders' long-term success. Titled "Not Sold on Diversity? Fine. Let's Talk About Your Bottom Line," the roundtable session will take place Wednesday, April 30, from 1 to 3 pm ET.

Argyle’s Daniel Esquibel recognized as a HousingWire Rising Star for 2025

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a service provider automating income and employment verifications for some of the largest lenders in the United States, today announced that Daniel Esquibel, head of partner sales, has been named a 2025 HousingWire Rising Star. The award recognizes emerging real estate and mortgage industry leaders who are shaping the future through their contributions and leadership.

Maggie Zielinski Swanson of FLOIFY named a HousingWire 2025 Rising Star

BOULDER, Colo. /Massachusetts Newswire: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that Enterprise Account Executive/Sales Engineer Maggie Zielinski Swanson has been named to HousingWire's prestigious Rising Stars list for 2025. Swanson, 29, joined Floify in 2021 as a skilled sales professional and has quickly become an indispensable force in the company's collaborative culture and growth.

Optimal Blue’s Shawn Chandwani Named to HousingWire’s 2025 Rising Star List

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today announced that Senior Software Engineering Manager Shawn Chandwani, 34, has been named among HousingWire's Rising Stars. The annual list celebrates young professionals who shoulder significant leadership responsibilities and contribute to the broader industry and business landscape, establishing themselves as influential figures and leaders for tomorrow.

Janet Pitney of Click n’ Close Honored with 2025 HousingWire Rising Stars Award

ADDISON, Texas /Massachusetts Newswire: -- Click n' Close (CNC), a multi-state mortgage lender, today announced that Project Manager Janet Pitney has been honored with a place among the 2025 HousingWire Rising Stars. The award honors young real estate and mortgage professionals making impressive career moves while driving growth for their companies and the industry. Pitney is recognized for her outstanding leadership and innovation in technology and operations.

ACES Quality Management’s Josh Reed Honored as 2025 Rising Star by HousingWire Magazine

DENVER, Colo. /Massachusetts Newswire: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the mortgage industry, today announced its Principal Application Architect Josh Reed has been honored among the 2025 HousingWire Rising Stars, which recognizes mortgage and real estate professionals under 40 who have made impactful career decisions driving growth in the industry and at their companies. Reed has been honored as a Rising Star for his outstanding contributions to innovation, efficiency, and compliance in the mortgage industry.

Informative Research Data Solutions’ Jooyoung Jung recognized as a 2025 HousingWire Rising Stars Honoree

GARDEN GROVE, Calif. /Massachusetts Newswire: -- Informative Research Data Solutions, a division of Informative Research and leading provider of data-powered borrower intelligence and analytics tools for the financial services industry, today announced its Data Solutions Team Lead Jooyoung Jung has been recognized as a 2025 HousingWire Rising Stars Honoree. The award highlights real estate and mortgage professionals under the age of 40 making impressive career moves while empowering growth and change among their peers.