Tag: Mortgage

Informative Research Data Solutions’ Jooyoung Jung recognized as a 2025 HousingWire Rising Stars Honoree

GARDEN GROVE, Calif. /Massachusetts Newswire: -- Informative Research Data Solutions, a division of Informative Research and leading provider of data-powered borrower intelligence and analytics tools for the financial services industry, today announced its Data Solutions Team Lead Jooyoung Jung has been recognized as a 2025 HousingWire Rising Stars Honoree. The award highlights real estate and mortgage professionals under the age of 40 making impressive career moves while empowering growth and change among their peers.

Praneeth Reddy Saripalli of Informative Research honored among 2025 HousingWire Rising Stars

GARDEN GROVE, Calif. /Massachusetts Newswire: -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, today announced that IT Development Manager Praneeth Reddy Saripalli has been honored as a recipient of the 2025 HousingWire Rising Stars Award. The award recognizes real estate and mortgage leaders 40 years old and under who drive growth and achieve remarkable career milestones. Saripalli's leadership, technical vision and ability to align people, processes and technology have been instrumental in Informative Research's continued growth and market leadership.

Sean Dugan to share leadership priorities as incoming Dark Matter CEO on The Big Picture Podcast

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 pm ET, this week features Sean Dugan, incoming CEO of Dark Matter Technologies. Dugan will join co-hosts Rich Swerbinsky, mortgage business consultant and executive coach, and Rob Chrisman, editor-in-chief of the widely followed Chrisman Commentary newsletter, to discuss his leadership vision, Dark Matter's newly announced servicing platform and strategies lenders can employ to stay competitive in a shifting mortgage landscape.

The Mortgage Collaborative demonstrated the power of its network, swiftly assisting lenders to resolve critical VA lending issue

SAN DIEGO, Calif. /Massachusetts Newswire: -- The Mortgage Collaborative (TMC) has once again demonstrated the power of its network by swiftly assisting lenders to resolve a critical VA lending issue that had stalled loan processing nationwide. Through rapid collaboration, direct engagement with the Department of Veterans Affairs (VA), and the persistence of key TMC members, impacted lenders regained their VA underwriting and insurance authority in just one week-ensuring veterans could move forward with their home purchases.

Cotality to Offer Optimal Blue’s Direct-Source Origination Data to Capital Markets, Research, and Investment Firms

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today announced a strategic alliance with Cotality™ (formerly CoreLogic®) that expands access to its mortgage origination and pricing data. Through this collaboration, Cotality will offer Optimal Blue's data to a broader audience, including hedge funds, capital markets participants, and investment firms seeking insights into the mortgage markets.

Figure Lending CEO Mike Tannenbaum appears on The Big Picture webcast

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 pm ET, this week features Mike Tannenbaum, CEO of Figure Lending, the nation's largest non-bank provider of home equity lines of credit. Tannenbaum will join co-hosts Rich Swerbinsky, mortgage business consultant and executive coach, and Rob Chrisman, editor-in-chief of the widely followed Chrisman Commentary newsletter, to explore the evolving role of fintech in mortgage lending.

Citizens joins CapitalW Collective in its mission to equip women with the resources and support needed to succeed in mortgage capital...

SAN DIEGO, Calif. /Massachusetts Newswire: -- CapitalW Collective, a leading non-profit dedicated to increasing the representation of women and their allies in mortgage capital markets, proudly announces Citizens as a Diamond-level corporate sponsor. This partnership reflects a shared commitment to fostering a more inclusive and dynamic mortgage capital markets industry by providing education, mentorship, and leadership opportunities, particularly for underrepresented professionals.

Fintech innovator, Dark Matter Technologies completes migration to AWS to enhance computing performance and scalability

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced the successful completion of its IT infrastructure migration to Amazon Web Services (AWS). This strategic move enhances Dark Matter's ability to deliver superior performance, scalability and reliability to mortgage industry clients

Chris Bennett, founder of Vice Capital Markets, joins The Big Picture webcast to recap Federal Reserve policy decisions

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 pm ET, this week features Chris Bennett, founder and chairman of Vice Capital Markets. Bennett will join Rich Swerbinsky, mortgage business consultant and executive coach, and Rob Chrisman, editor-in-chief of the widely followed Chrisman Commentary newsletter, to explore key trends in capital markets, the impact of Federal Reserve policy on mortgage rates and the evolving strategies lenders are using to manage risk in today's volatile market.

Collaboration Between Mortgage Capital Trading and Fannie Mae Improves Pricing for Mortgage Sellers

SAN DIEGO, Calif. /Massachusetts Newswire: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced their integration with Fannie Mae's new Loan Pricing API. By combining various price factors and utilizing a broader set of data found in bid tapes, the new API provides greater price transparency on certain loans. This is the latest in a series of recent collaborations between MCT and Fannie Mae intended to provide additional benefit and value to mortgage secondary market participants.

To Streamline Mortgage Loan Pricing and Commitment, Vice Capital Markets Integrates with Fannie Mae’s Loan Pricing API

NOVI, Mich. /Massachusetts Newswire: -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today it is the first to integrate Fannie Mae's new Loan Pricing application programming interface (API) into its trading portal. The API consolidates multiple APIs into one, simplifying the loan pricing process and enhancing pricing and commitments.

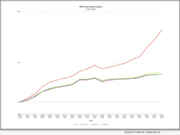

Mortgage Capital Trading (MCT) today announced a 27.91% increase in mortgage lock volume compared to the previous month

SAN DIEGO, Calif. /Massachusetts Newswire: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced a 27.91% increase in mortgage lock volume compared to the previous month. Industry professionals and stakeholders are encouraged to download the full report for a detailed analysis.

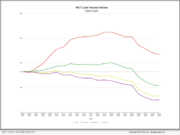

Feb. 2025 Market Advantage report indicates stabilizing conforming loan share amid refinance growth and sluggish purchase activity

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today released its February 2025 Market Advantage mortgage data report, showing a 7% month-over-month increase in mortgage lock volume driven primarily by a surge in refinance activity. Rate-and-term refinances saw the biggest jump, rising nearly 40% as homeowners seized the opportunity to lower their monthly payments. Cash-out refinances also edged higher, while purchase lock activity remained subdued for the second consecutive month.

The Mortgage Collaborative 2025 Mortgage Tech Day Presents 5 Startups to Compete in Dallas Pitch Even

DALLAS, Texas /Massachusetts Newswire: -- The future of mortgage technology is set to take the spotlight in Dallas as The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, and the TMC Emerging Technology Fund LP present the seventh Mortgage Tech Day (MTD).

Nikki Bialka of Fifth Third Bank to spotlight fair lending strategies and equitable homeownership on The Big Picture

CLEVELAND, Ohio /Massachusetts Newswire: -- In recognition of Fair Lending Month and Women's History Month, this week's episode of top mortgage industry webcast The Big Picture will feature Nikki Bialka, vice president and national community lending strategy manager at Fifth Third Bank, in a discussion on bridging the homeownership gap for BIPOC and low-to-moderate-income (LMI) communities through equitable lending practices. Airing live Thursday at 3 pm ET, the episode will explore innovative mortgage programs, special-purpose credit programs (SPCPs), alternative credit models and strategies for embedding equity into lending practices beyond regulatory compliance.

Digital mortgage automation leader, Floify taps Sol Klein as head of client experience and business operations

BOULDER, Colo. /Massachusetts Newswire: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced the appointment of Sol Klein as head of client experience and business operations. Klein, a seasoned mortgage technology executive with extensive experience in customer success and implementation, will lead initiatives to help clients maximize the value of their investment in Floify's platform.

Three of Dark Matter’s team members have been recognized by HousingWire, the Mortgage Bankers Association (MBA), and Women We Admire

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced that three of its team members have been recognized by HousingWire, the Mortgage Bankers Association (MBA), and Women We Admire.

Kortney Lane-Schafers Named VP of Growth and Client Advocacy at MMI

SALT LAKE CITY, Utah /Massachusetts Newswire: -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, is pleased to announce the promotion of Kortney Lane-Schafers to Vice President of Growth & Client Advocacy.

Cloudvirga completes Horizon Retail POS integration with ICE Mortgage Technology

IRVINE, Calif. /Massachusetts Newswire: -- Cloudvirga, a leading provider of digital mortgage point-of-sale platforms, today announced Cloudvirga's Horizon Retail POS integration using Encompass Partner Connect, the latest API framework for mortgage technology from Intercontinental Exchange (ICE). This modern framework enables industry participants to integrate to ICE solutions and provide their services to loan originators and servicers through secure API-enabled technology.

Fannie Mae STAR Program recognizes Dovenmuehle Mortgage, Inc. (DMI) for excellence in mortgage servicing

LAKE ZURICH, Ill. /Massachusetts Newswire: -- Dovenmuehle Mortgage, Inc. (DMI), a leading mortgage subservicing company, announced today that Fannie Mae has once again recognized the company with their Servicer Total Achievement and Rewards™ (STAR™) Servicer Award for outstanding servicing performance during the 2024 program year. This honor marks the fourth time Fannie Mae has recognized DMI for servicing excellence.

CEO Laird Nossuli of iEmergent recognized among NMP 2025 Diversity Leaders

DES MOINES, Iowa /Massachusetts Newswire: -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced that CEO Laird Nossuli has been named a 2025 Diversity Leader by National Mortgage Professional (NMP) magazine. The award recognizes mortgage professionals who have demonstrated dedication and success in promoting inclusivity within their companies or the communities they serve.

Floify introduces Dynamic Apps: No-code custom loan applications supports faster loan processing

BOULDER, Colo. /Massachusetts Newswire: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced Dynamic Apps, a no-code feature that lets lenders tailor loan applications based on loan type. By eliminating irrelevant questions, Dynamic Apps shapes the home financing journey to borrowers' unique goals while helping lenders accelerate approvals, improve application completion rates and maintain regulatory compliance.

CEO Stan Middleman of Freedom Mortgage to share market insights on The Big Picture webcast

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 pm ET, this week features Stan Middleman, founder and CEO of Freedom Mortgage Corporation. Middleman will join Rich Swerbinsky, a renowned mortgage business consultant and executive coach, and Rob Chrisman, editor-in-chief of the widely acclaimed Chrisman Commentary newsletter, to provide expert insights into the current mortgage market.

MCT (Mortgage Capital Trading) Introduces Atlas: Generative AI Advisor for Mortgage Capital Markets

SAN DIEGO, Calif. /Massachusetts Newswire: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, today announced the release of Atlas, an artificial intelligence (AI) advisor now available within the MCTlive! platform. Atlas serves as a virtual capital markets expert and high-quality educational resource for MCT's mortgage lender clients. With this launch, effective February 10, 2025, MCT continues its tradition of innovation in secondary marketing technology.

Technology Partner of the Year: Down Payment Resource receives ICE Mortgage Technology’s 2025 Innovation Award

ATLANTA, Ga. /Massachusetts Newswire: -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced that it has been named the 2025 ICE Innovation Technology Partner of the Year by Intercontinental Exchange, Inc. (ICE), a leading global provider of data, technology and market infrastructure.

Down Payment Resource honors Mosi Gatling with Beverly Faull Affordable Housing Leadership Award and Skyler Lemons with Emerging Leader Award

ATLANTA, Ga. /Massachusetts Newswire: -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, announced today that it has honored Mosi Gatling of New American Funding (NAF) with the 2024 Beverly Faull Affordable Housing Leadership Award, and Skyler Lemons of Exit Strategy Realty with hits inaugural Emerging Leader Award.

MMI Earns Third Consecutive HousingWire Tech100 Mortgage Award for 2025

SALT LAKE CITY, Utah /Massachusetts Newswire: -- Mobility Market Intelligence (MMI), a market leader in data intelligence and market insight tools for the mortgage and real estate industries, has been named to the 2025 HousingWire Tech100 Mortgage list, marking the company's third consecutive year receiving this prestigious honor. The Tech100 Mortgage award recognizes the most innovative and impactful technology companies in the mortgage industry, highlighting solutions that drive efficiency, improve operations, and redefine what's possible in housing.

Cloudvirga joins ACUMA, strengthen member relationships while enhancing lending efficiency

IRVINE, Calif. /Massachusetts Newswire: -- Cloudvirga, a leading provider of digital mortgage point-of-sale platforms, has joined the American Credit Union Mortgage Association (ACUMA) as an affiliate member. Through its membership, Cloudvirga aims to support credit unions in delivering exceptional member lending experiences while improving efficiency through automation and intelligent workflow solutions.

TMC Annual Mortgage Lender Survey Highlights Key Challenges and Priorities for 2025

SAN DIEGO, Calif. /Massachusetts Newswire: -- The Mortgage Collaborative (TMC), a leading network of mortgage lenders dedicated to innovation and collaboration, has released its latest Pulse of the Network report, offering key insights into the challenges and opportunities shaping the mortgage industry in 2025. The survey, conducted with decision-makers-including CEOs, COOs, and department heads from banks, credit unions, and independent mortgage banks (IMBs)-highlights how lenders are preparing for a shifting market landscape.

Urban Institute Fellow Jim Parrott joins The Big Picture Webcast on Feb 27 to break down housing policy

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 pm ET, this week features Jim Parrott, a nonresident fellow at the Urban Institute and co-founder of Parrott Ryan Advisors. Parrott will join hosts Rich Swerbinsky and Rob Chrisman to discuss key housing policy developments shaping today's mortgage landscape.

AccountChek expands payroll provider network for mortgage lenders assessing Freddie Mac AIM

GARDEN GROVE, Calif. /Massachusetts Newswire: -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, announced an enhancement to its integration with Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM). This enhancement enables LPA to assess income and employment for eligibility of representation and warranty relief for lenders using AccountChek® for automated verification of income and employment (VOIE) across a broad range of supported payroll providers.

Laird Nossuli, iEmergent CEO, to speak at 2025 CU:REALM Live!

DES MOINES, Iowa /Massachusetts Newswire: -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced that its CEO, Laird Nossuli, will present at the 2025 CU: REALM Live! April 14-15 in San Diego, California. Nossuli will lead the day one session on "Utilizing Market-level Mortgage Data to Increase Referrals and Grow Originations," offering credit union leaders actionable strategies for leveraging localized mortgage data to expand their member base and grow lending volume.

Patrick O’Brien, LenderLogix CEO, breaks down the future of mortgage tech on The Big Picture webcast

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 pm ET, this week features Patrick O'Brien, co-founder and chief executive officer of LenderLogix, as a guest on its upcoming episode. O'Brien will share insights on the evolving mortgage technology landscape, the impact of automation on lending and how lenders can leverage digital tools to enhance borrower experiences.

MMI has acquired MonitorBase, a borrower monitoring and predictive analytics platform

SALT LAKE CITY, Utah /Massachusetts Newswire: -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, has acquired MonitorBase, a borrower monitoring and predictive analytics platform. This acquisition, following MMI's recent addition of Bonzo, a CRM and conversation platform, unites data intelligence, borrower monitoring, and automated engagement into a seamless, end-to-end system for mortgage professionals.

The ACES Q3/2024 Mortgage QC Trends Report shows a sharp rise in insurance defects for second time this year

DENVER, Colo. /Massachusetts Newswire: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the third quarter (Q3) of 2024. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

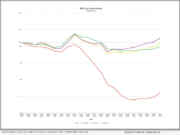

Optimal Blue’s January 2025 Market Advantage mortgage data report highlights a softening purchase market, boost in refi demand among elevated rates

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today released its January 2025 Market Advantage mortgage data report, revealing a sharp rise in year-over-year (YoY) refinance activity alongside a drop in purchase lock counts. The decline in purchase lock counts marks the lowest January count since Optimal Blue began tracking this data in 2019. Meanwhile, refinance lock volume surged even though the Optimal Blue Mortgage Market Indices (OBMMI) 30-year ticked above 7% for the first time since May.

Informative Research Expanding Mortgage Verification Platform Connectivity, Integrates with Thomas and Company

GARDEN GROVE, Calif. /Massachusetts Newswire: -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, today announced its integration with Thomas & Company, a leading provider of value-added employer services and innovative solutions to support employee relations programs. The integration adds Thomas & Company's Wage and Employment Verification service to Informative Research's verification platform.

Argyle has announced significant enhancements to its integration with nCino (NASDAQ: NCNO)

NEW YORK CITY, N.Y. /Massachusetts Newswire: -- Argyle, a service provider automating income and employment verifications for some of the largest mortgage lenders in the United States, today announced significant enhancements to its integration with nCino (NASDAQ: NCNO), the leading provider of intelligent, best-in-class banking solutions.

The Big Picture with Rich Swerbinsky and Rob Chrisman spotlights Rate’s Laura Schmidt

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, this week features Laura Schmidt, senior vice president of enterprise risk and internal audit at Rate, a leading residential mortgage lending company based in Chicago. With extensive experience in enterprise risk, internal audits and regulatory management, Schmidt offers valuable insights for lenders looking to mitigate risk and ensure compliance in today's financial services landscape.

Mortgage Lock Volume Stays Flat in Latest MCT 2025 February Indices

SAN DIEGO, Calif. /Massachusetts Newswire: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 0.12% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report for a deeper understanding of the latest market trends and dynamics.

Fannie Mae Vice President Bill Cleary to Speak at ACES Quality Management Conference in Colorado

DENVER, Colo. /Massachusetts Newswire: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has announced that Bill Cleary, vice president of Single-Family Credit Risk Loan Quality at Fannie Mae, will speak at the ACES ENGAGE conference at The Broadmoor Resort in Colorado Springs, Colo., May 18-20, 2025.

SmartBuy Shared Appreciation Mortgage Program from Click n’ Close expands to Freddie Mac 30-year conventional loans

ADDISON, Texas /Massachusetts Newswire: -- Click n' Close (CNC), a multi-state mortgage lender, today announced its SmartBuy™ Shared Appreciation Mortgage (SAM) program now features a 30-year, fixed-rate conventional option approved by Freddie Mac.

Optimal Blue Introduces Seven Major Innovations at Its Inaugural User Summit in California

SAN DIEGO, Calif. /Massachusetts Newswire: -- Optimal Blue today unveiled a series of new products and features, alongside its major Ask Obi AI assistant announcement, at its Summit user conference in San Diego. These innovation announcements underscore the company's commitment to delivering high-impact solutions, at no additional cost, that tackle real-world challenges and help lenders maximize profitability.

Optimal Blue Launches Ask Obi AI Assistant to Provide Mortgage Lending Execs with Real-Time Business Insights

SAN DIEGO, Calif. /Massachusetts Newswire: -- Optimal Blue today announced Ask Obi, an AI assistant designed to provide mortgage lending executives with instant, actionable insights from their Optimal Blue products and data. Unveiled during Optimal Blue's inaugural Summit user conference in San Diego, Ask Obi gives lenders the power to view their operations holistically with data aggregation across Optimal Blue's comprehensive capital markets platform.

The Big Picture with Rich Swerbinsky and Rob Chrisman showcases Optimal Blue CEO Joe Tyrrell on Podcast

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, this week features Joe Tyrrell, CEO of Optimal Blue, a leading provider of comprehensive capital markets solutions. With over 25 years of experience in mortgage, finance and technology, Tyrrell will share insights for lenders seeking to fine-tune profitability in secondary market transactions and enhance operational efficiency through technology.

Down Payment Resource has been named to the HousingWire 2025 Mortgage Tech100 list

ATLANTA, Ga. /Massachusetts Newswire: -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, has been named to HousingWire's 2025 Mortgage Tech100 list, which recognizes "the companies and solutions that are revolutionizing the mortgage process - from origination to closing, and servicing to secondary markets."

iEmergent today announced the release of four new market intelligence dashboards

DES MOINES, Iowa /Massachusetts Newswire: -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the release of four new market intelligence dashboards that make it easy for lenders to slice, visualize, export and share historical and forecasted loan production, real estate listing and demographic data.

NotaryCam Drives Digital Transformation with Record Growth in 2024 and Net Promoter Score (NPS) of 86

HOUSTON, Texas /Massachusetts Newswire: -- NotaryCam®, a Stewart-owned company and leading remote online notarization (RON) provider for real estate and legal transactions, announced a milestone year in 2024, having completed more than 154,000 RON transactions. The company also experienced a 26% increase in loss mitigation-related RON transactions through its real estate vertical, reflecting its ability to address lenders' needs for efficient borrower support.

The Big Picture podcast dives into housing finance reform with Mark A. Calabria

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, hosted by Rich Swerbinsky and Rob Chrisman and broadcast live every Thursday at 3 pm ET, this week features Mark A. Calabria, a senior advisor at nonpartisan public policy research organization the Cato Institute and former director of the Federal Housing Finance Agency (FHFA). Drawing on his decades of experience shaping U.S. economic policy, Calabria will share insights into the federal policymaking process.

Dark Matter Technologies announces agenda 2025 for second annual Horizon User Conference

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology, today announced the agenda for its Horizon User Conference. Exclusive to Dark Matter clients and partners, the conference will take place at the Omni Amelia Island on April 22-24.

San Diego-based The Mortgage Collaborative Appoints Jodi Hall as New CEO

SAN DIEGO, Calif. /Massachusetts Newswire: -- The Mortgage Collaborative (TMC), the nation's leading network of independent mortgage lenders, banks, credit unions, and service providers, is proud to announce the appointment of Jodi Hall as its new Chief Executive Officer and President.

The LenderLogix Q4 2024 Homebuyer Intelligence Report

BUFFALO, N.Y. /Massachusetts Newswire: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the fourth quarter (Q4) of 2024.

Down Payment Resource’s Q4 2024 HPI Report finds 2,466 homebuyer assistance programs available in U.S.

ATLANTA, Ga. /Massachusetts Newswire: -- Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q4 2024 Homeownership Program Index (HPI) report. The report saw the number of homebuyer assistance programs increase by 172 and the number of entities offering them increase by 75 year-over-year (YoY), bringing the total number of available programs to 2,466.

Mortgage Capital Trading Unveils MSRlive! 4.0, Offering New Enhancements to MSR Reporting and Transparency

SAN DIEGO, Calif. /Massachusetts Newswire: -- Mortgage Capital Trading (MCT), the de facto leader in innovative mortgage capital markets technology, today announced the release of MSRlive! 4.0, a groundbreaking enhancement to its mortgage servicing rights (MSR) valuation platform. The latest version offers mortgage servicers an unprecedented level of transparency and business intelligence, equipping portfolio managers with powerful new tools to assess and optimize their

Mortgage Capital Trading (MCT) Reports 16% Decrease in Mortgage Lock Volume Amid Market Dynamics

SAN DIEGO, Calif. /Massachusetts Newswire: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, announced today a 16.7% decrease in mortgage lock volume compared to the previous month. Industry professionals and market enthusiasts are encouraged to download the complete report to gain comprehensive insights into the evolving market dynamics.

ACES Quality Management Increases Financial Services QC Audit Volume by 15% in 2024

DENVER, Colo. /Massachusetts Newswire: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has sought to support its customers through turbulent market conditions by providing critical technology innovations to its quality control audit suite.

Optimal Blue’s December 2024 Market Advantage report highlights annual mortgage production gains and record low conforming loan share

PLANO, Texas /Massachusetts Newswire: -- Optimal Blue today released its December 2024 Market Advantage mortgage data report, showcasing year-over-year (YoY) growth in mortgage activity, even as seasonal trends led to a month-over-month (MoM) decline in rate lock volumes. Overall, December mortgage lock volume was up 26% YoY, driven by an 18% increase in purchase locks, a 43% rise in cash-out refinances, and an 82% jump in rate-and-term refinances.

The Big Picture podcast spotlights Council of FHLBanks CEO Ryan Donovan as guest

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry webcast The Big Picture, hosted by Rich Swerbinsky and Rob Chrisman and broadcast live every Thursday at 3 p.m. ET, next week features Ryan Donovan, president and chief executive officer of the Council of Federal Home Loan Banks, a trade association representing the positions and views of the Federal Home Loan Bank System.

Polly and Nonprofit CapitalW Collective Align to Support Women in Mortgage Capital Markets

SAN DIEGO, Calif. /Massachusetts Newswire: -- CapitalW Collective, a trailblazing non-profit dedicated to advancing women and their allies in mortgage capital markets, proudly announces Polly as its first product and pricing engine (PPE) Diamond-level corporate sponsor. This alliance underscores CapitalW Collective's mission "to create more inclusive and dynamic mortgage capital markets, one woman and ally at a time."

Mortgage Machine Fully Integrates AI-Powered Pricing Engine into Proprietary Loan Origination System

ADDISON, Texas /Massachusetts Newswire: -- Mortgage Machine Services (Mortgage Machine), an industry leader in digital origination technology to residential mortgage lenders, announced that it now offers an artificial intelligence (AI)-powered pricing engine. The pricing engine ingests and updates pricing for a lender's investors and aggregators automatically.

Top mortgage industry podcast The Big Picture welcomes Floify President Sofia Rossato as Jan. 9 guest

CLEVELAND, Ohio /Massachusetts Newswire: -- Top mortgage industry podcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, this week features technology executive Sofia Rossato, president and general manager of Floify, a leading mortgage point-of-sale solution and subsidiary of Porch Group, Inc. A respected proptech and fintech executive with more than 20 years' experience growing companies in startup and large corporate environments, Rossato brings a market-tested perspective to the challenges and opportunities mortgage lenders contend with during the U.S. housing industry's fluctuations.

Dark Matter Technologies Names Brad Vasto as Chief Revenue Officer (CRO)

JACKSONVILLE, Fla. /Massachusetts Newswire: -- Dark Matter Technologies (Dark Matter®), an innovative leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the appointment of Brad Vasto as Chief Revenue Officer (CRO). Vasto steps into the role as Sean Dugan, the outgoing CRO, prepares to assume the position of CEO in April 2025, succeeding current CEO Rich Gagliano.

Jason Mapes, Floify’s head of sales, named a 2024 PROGRESS in Lending Thought Leader

BOULDER, Colo. /Massachusetts Newswire: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that its Head of Sales, Jason Mapes, has been named a 2024 Thought Leader by PROGRESS in Lending (PIL). Now in its fourth year, PIL's Thought Leader award recognizes industry thought leaders who are not afraid to "step forward and blaze a new trail."

Dovenmuehle Earns FHA Tier 1 Rating from HUD’s Tier Ranking System (TRS) II Scorecard

LAKE ZURICH, Ill. /Massachusetts Newswire: -- Dovenmuehle Mortgage, Inc., a leader in mortgage subservicing, announced today that it received a Tier 1 Rating from the U.S. Department of Housing and Urban Development (HUD). This rating was awarded for Dovenmuehle's Federal Housing Administration (FHA) servicing performance under HUD's Tier Ranking System II (TRS II).

Informative Research’s Ryan Kaufman Named to 2024 NMP 40 Under 40 List

IRVINE, Calif. /Massachusetts Newswire: -- Informative Research, a premier technology provider delivering data-driven credit and verification solutions to the lending community, announced that Ryan Kaufman, IT Manager of Integrations, has been named to the National Mortgage Professional (NMP) 40 Under 40 list. This honor recognizes exceptional professionals who are influencing the future of the mortgage industry.