Optimal Blue’s September 2024 Market Advantage mortgage data report released in conjunction with the inaugural Market Advantage podcast featuring Mortgage Bankers Association economist Joel Kan guest commentator

PLANO, Texas, Oct. 8, 2024 (SEND2PRESS NEWSWIRE) — Optimal Blue today released its September 2024 Market Advantage mortgage data report, which found a 50% month-over-month (MoM) increase in rate-and-term refinance activity as people who purchased homes in recent years jumped at the opportunity to lower their interest rates and mortgage payments. While the Federal Open Market Committee (FOMC) lowered its target federal funds rate by 50 bps on Sept. 18, the market had already priced in a portion of the rate reduction, leading to a full month of increased refinance activity in September.

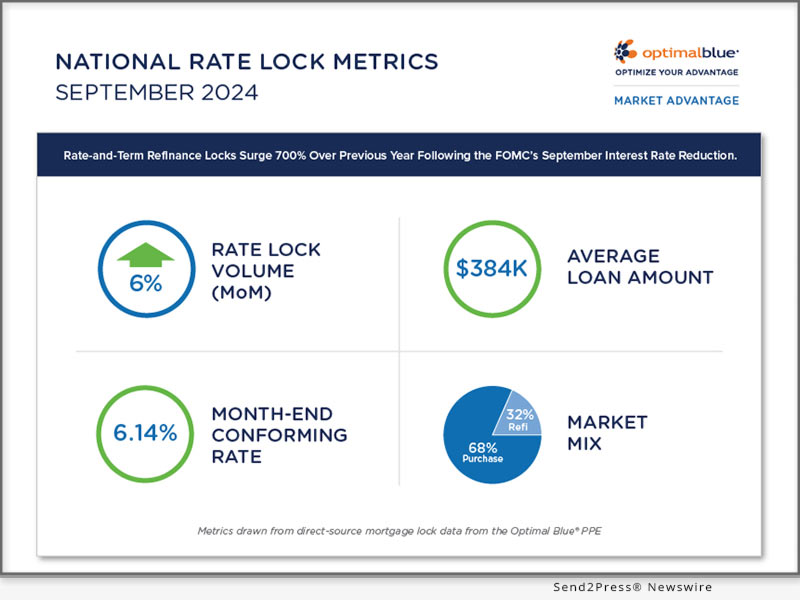

Image caption: Optimal Blue Sept. 2024 Report.

“Refinance production has been trending higher for a few months now as mortgage rates rallied, but purchase activity had been stubbornly stagnant. However, September volumes indicate the tide may be turning,” said Brennan O’Connell, director of data solutions at Optimal Blue. “Excluding April of this year, which was impacted by the timing of Easter, September marks the first month with a year-over-year (YoY) increase in purchase locks since the Fed began raising rates in Spring of 2022. As we move into Q4, this is a very encouraging sign that the market may have found a floor and production is on the upswing.”

Key findings from the Market Advantage report, which are drawn from direct-source mortgage lock data, include:

- Refinance volumes surge: On an absolute basis, refinance production reached the highest level seen since January 2022. Rate-and-term refinance lock volume was up nearly 50% MoM and 700% YoY. Cash-out refinance volume rose a more modest 6% MoM but was still up more than 50% YoY.

- Mortgage rates fall across the board: The Optimal Blue Mortgage Market Indices (OBMMI) 30-year conforming benchmark interest rate dropped 23 bps, while jumbo, FHA, and VA rates were down 22, 25, and 16 bps, respectively. The drop in mortgage interest rates did not directly correspond to the 50 bps FOMC rate cut because an anticipatory market had already priced a reduction in rates leading into September.

- Conventional and VA production grew market share: The share of conforming loan production rose roughly .5% to 54.4%, and the share of non-conforming production – including jumbo and non-QM loans – rose .25% to 12.6%. The share of FHA loans fell roughly 1% to 18.7%, while VA rose .2% to 13.7%.

- Average borrower credit increased across the board: The credit scores of rate-and-term refinance borrowers rose an average of 6 points to 737. The average conventional borrower credit score rose to 757, the highest since December 2020.

- Average loan amounts and home prices rose: From August 2024 to September 2024, the average loan amount increased from $372.4K to $383.7K. The average home purchase price ticked up $10K to $475.8K after falling the previous two months.

The inaugural Market Advantage podcast has been released today in conjunction with the September Report. This month’s podcast features Joel Kan, vice president and deputy chief economist at the Mortgage Bankers Association, as a guest commentator. The podcast can be accessed at: https://market-advantage.captivate.fm/listen.

The full September 2024 Market Advantage report, which provides more detailed findings and additional insights into U.S. mortgage market trends, can be viewed at: https://www2.optimalblue.com/wp-content/uploads/2024/10/OB_MarketAdvantage_MortgageDataReport_Sept2024.pdf.

About the Market Advantage Report:

Formerly known as the Originations Market Monitor, Optimal Blue issues the Market Advantage mortgage data report each month to provide early insight into U.S. mortgage trends. Leveraging lender rate lock data from the Optimal Blue PPE – the mortgage industry’s most widely used product, pricing, and eligibility engine – the Market Advantage provides a view of early-stage origination activity. Unlike self-reported survey data, mortgage lock data is direct-source data that accurately reflects the in-process loans in lenders’ pipelines.

Nothing herein shall be construed as, nor is Optimal Blue providing, any legal, trading, hedging, or financial advice.

About Optimal Blue

Optimal Blue effectively bridges the primary and secondary mortgage markets to deliver the industry’s only end-to-end capital markets platform. The company helps lenders of all sizes and scopes maximize profitability and operate efficiently so they can help American borrowers achieve the dream of homeownership. Through innovative technology, a network of interconnectivity, rich data insights, and expertise gathered over more than 20 years, Optimal Blue is an experienced partner that, in any market environment, allows lenders to optimize their advantage from pricing accuracy to margin protection, and every step in between. To learn more, visit https://OptimalBlue.com/.

LOGO link for media: https://www.Send2Press.com/300dpi/14-0625-s2p-optimal-blue-300dpi.jpg

NEWS SOURCE: Optimal Blue

This press release was issued on behalf of the news source (Optimal Blue), who is solely responsible for its accuracy, by Send2Press Newswire.

To view the original story, visit: https://www.send2press.com/wire/rate-and-term-refinance-locks-surge-700-over-previous-year-following-the-fomcs-september-interest-rate-reduction/

Copr. © 2024 Send2Press® Newswire, Calif., USA. — REF: S2P STORY ID: S2P121327 NEONET25B