Tag: FinTech

Trust Lending Leverages ReverseVision Fintech Platform to Grow Reverse Mortgage Wholesale Business

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- ReverseVision®, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced that Trust Lending, a national mortgage banker, has gone live with ReverseVision's Exchange (RVX) platform for its wholesale lending channel. The platform helped Trust Lending springboard its wholesale channel into easily and expeditiously originating loans for reverse mortgage products.

After, Inc. and PermaPlate Partnership to Deliver PermaPlate Furniture Protection to Online Furniture Retailers

NORWALK, Conn. /Massachusetts Newswire - National News/ -- After, Inc., the leading customer experience technology company providing software and services to the world's top manufacturers, retailers and merchants, today announced its partnership with PermaPlate Furniture, the furniture protection plan division of PermaPlate®.

Promontory MortgagePath promotes Kevin Wheeler to managing director of product and engineering

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today it has promoted Kevin Wheeler to managing director of product and engineering. Wheeler previously held the position of director of backend engineering at Promontory MortgagePath.

New DocMagic eDecision Fully Automates and Perfects Digital Closing Eligibility

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of fully compliant loan document preparation, automated regulatory compliance, and comprehensive eMortgage services, announced the rollout of eDecision™, a robust solution that significantly expands the level of analysis applied to e-eligibility determination for eClosings.

Simatree advisory practice acquired by Galway Holdings

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Galway Holdings ("Galway") today announced its acquisition of Virginia-based Simatree, a strategic advisory firm specializing in data, analytics, technology consultation and digital transformation. Fast-growing, Simatree has won multiple awards for its innovative and transformational digital and analytics solutions, founded by Patrick McCreesh, Wes Flores and Jay Williams, former NBA player and current television analyst.

Own Up and HomeBinder announce strategic partnership to strengthen borrower relationships with lenders and home pros

BOSTON, Mass. /Massachusetts Newswire/ -- HomeBinder, a centralized home management platform that keeps homeowners connected with mortgage lenders, home inspectors, Realtors and other authorized professionals, today announced a strategic partnership with Boston-based Own Up to support homeowners who receive HomeBinder from a non-mortgage industry business, such as a home inspector or insurance agent.

Lender Price and Blend Announce Integration to Enhance User Experience for Digital Lending Process

PASADENA, Calif. /Massachusetts Newswire - National News/ -- Lender Price and Blend have partnered to provide an enhanced digital experience for both financial services firms and consumers. The integration couples Blend with Lender Price's FLEX Pricing product via APIs to provide custom pricing questions that will help match a consumer to the appropriate loan program and rate.

HomeBinder and Thumbtack partnership to expand homeowner access to home service professionals nationwide

BOSTON, Mass. /Massachusetts Newswire/ -- HomeBinder, a centralized home management platform that keeps homeowners connected with mortgage lenders, Realtors and other authorized professionals, today announced a new integration with Thumbtack. The integration expands upon the more than 23,000 recommended service providers already listed in HomeBinder.

Certa Partners with Comply Exchange, a global leader in tax compliance

SARATOGA, Calif. /Massachusetts Newswire - National News/ -- Certa, the leading no-code third party risk management platform today announced its integration with Comply Exchange, a global leader in tax compliance. Certa is the only platform that digitizes, orchestrates, and automates the entire third-party journey across procurement, compliance, IT, legal, finance, and other groups.

Dynamic Learning Center to Empower Mortgage Lender Growth and Profitability Launched by Mortgage Capital Trading

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), a recognized industry leader in mortgage risk management providing pipeline hedging, best execution loan sales and centralized lock desk services, announced the debut of its new Learning Center, a one-stop educational content database for each stage of growth of a mortgage lender in the secondary market.

OpenClose Launches Mobile Assist Native Mobile App Platform for Mortgage Industry

WEST PALM BEACH, Fla. /Massachusetts Newswire - National News/ -- OpenClose®, the leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders, today announced the launch of its native mobile app platform, Mobile Assist™. Mobile Assist adds features and functionality to make originators more successful with a real-time omnichannel device platform.

New Mortgage Coach integration with ICE Mortgage Technology enables lenders to deliver accurate loan comparisons

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, today announced an advanced integration with ICE Mortgage Technology™, part of Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure.

Winnow Solutions partners with ACES to ensure users audit to the most accurate regulatory standards and requirements

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has partnered with Winnow Solutions to power certain compliance and regulatory operations within ACES through its RegTech platform Winnow®.

New Sales Boomerang feature empowers mortgage advisors with historical context that makes customer outreach hyper-relevant

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the availability of a new feature that lets lenders view a history of Sales Boomerang alerts that have previously triggered for each contact in their monitored database.

Sales Boomerang’s Mike Spotten recognized as 2021 HW Tech Trendsetter for innovations in mortgage technology

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that Mike Spotten, vice president of product, was named a 2021 HW Tech Trendsetter by HousingWire Magazine. Now in its third year, the HW Tech Trendsetters award program highlights the leading players in the housing economy who drive innovation with advanced digital products and services.

Fintech Innovator, Sales Boomerang named 49th fastest-growing company in North America on 2021 Deloitte Fast 500

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang today announced it ranked 49 on the Deloitte Technology Fast 500™, a ranking of the 500 fastest-growing technology, media, telecommunications, life sciences, fintech and energy tech companies in North America, now in its 27th year. Sales Boomerang grew 3,882% during this period.

Mortgage Coach borrower conversion platform announced its integration with First American Title Insurance Company

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, today announced its integration with First American Title Insurance Company, a leading provider of title insurance and settlement services and the largest subsidiary of First American Financial Corporation (NYSE: FAF).

ReverseVision adds Eric Samuelson as VP of Finance and Andres Ochoa as Systems Administrator

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- ReverseVision, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced that it added Eric Samuelson as vice president of finance and Andres Ochoa as systems administrator. The two positions will play key roles in optimizing internal functions and prepping the company to scale.

Fintech Innovator FormFree Ranked #379 on 2021 Deloitte Fast 500

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree today announced it ranked 379 on the Deloitte Technology Fast 500, a ranking of the 500 fastest-growing technology, media, telecommunications, life sciences, fintech and energy tech companies in North America, now in its 27th year.

Nomis Solutions Announces Alliance with JD Power to Deliver Enhanced Automotive Finance Pricing Strategies

SAN FRANCISCO, Calif. /Massachusetts Newswire - National News/ -- Nomis Solutions (Nomis), a global, industry-leading pricing and profitability management solutions provider, announced it has formed a strategic collaboration with J.D. Power, a global leader in data analytics and consumer intelligence, to deliver enhanced automotive financing price optimization to financial institutions throughout the United States and Canada.

Mortgage Industry Veteran Bill Mitchell named Chief Revenue Officer at ReverseVision

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- ReverseVision, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced that it has hired Bill Mitchell as chief revenue officer (CRO).

SimpleNexus helps mortgage lenders better serve Spanish-speaking borrowers with Nexus Bilingual

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced the release of Nexus Bilingual(tm), a new feature that makes the loan process more accessible to prospective homebuyers who prefer to communicate in Spanish by gathering initial loan information in Spanish.

Promontory MortgagePath’s fintech solutions receive renewed ABA endorsement

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced the renewal of its product endorsement by the American Bankers Association (ABA). Promontory MortgagePath combines extensive mortgage operations and compliance expertise with industry-leading mortgage technology to provide efficient, cost-effective mortgage processing and fulfillment services to lenders of all sizes.

TMC Mortgage Tech Day 2022 coming in conjunction with TMC’s Winter Conference

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") will host TMC Mortgage Tech Day on March 19, 2022, in conjunction with TMC's Winter Conference at the Fontainebleau Miami Beach.

ACES Quality Management announces ACES ENGAGE, a 2-day conference defining the future of quality management and control

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management™ (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the launch of ACES ENGAGE, a conference designed to bring together the nation's top financial services quality management professionals to discuss industry trends and best practices.

Mortgage Coach integrates with Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, the borrower conversion platform empowering mortgage lenders to deliver clear mortgage advice and lending education with the interactive Total Cost Analysis (TCA) loan comparison, today announced an integration with Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system.

FormFree integrates with OpenClose enhancing lending experience with quick and easy borrower-permissioned data verification

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® Founder and CEO Brent Chandler today announced the availability of its AccountChek® financial data verification service within OpenClose®, the leading fintech provider of mortgage software solutions for banks, credit unions and mortgage lenders. The integration embeds AccountChek into OpenClose's ConsumerAssist(tm) Enterprise POS and LenderAssist(tm) LOS, giving borrowers the freedom to electronically permission verification data with ease when applying for a mortgage loan.

Mortgage Coach and HomeBinder Integration automates Total Cost Analysis (TCA) mortgage loan comparisons within HomeBinder’s home management platform

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, the mortgage industry's leading platform enabling lenders to create digital and accurate home loan options for consumers, today announced an integration with HomeBinder, a centralized home management platform that keeps homeowners connected with mortgage lenders, Realtors and other authorized professionals.

Dawn Taylor, formerly of Centricity, joins After, Inc. as Chief Revenue Officer

NORWALK, Conn. /Massachusetts Newswire - National News/ -- After, Inc., the global leader in Warranty Services since 2005, just announced that Dawn Taylor will be joining the company as Chief Revenue Officer. Dawn brings more than 27 years of warranty and service contract experience, serving as President of Centricity for the last 9 years. Her background and experience will be instrumental in leading the expansion of After, Inc.'s Warranty Services business, and its newly launched QuickSuite Platform.

Global DMS EVO Platform enhances Digital Mortgage efficiency with Amazon Alexa Voice Command Interface

LANSDALE, Pa. /Massachusetts Newswire - National News/ -- Global DMS, the leading provider of cloud-based real estate appraisal management software, recently announced that its next-generation EVO platform is now voice-enabled, providing lenders access to key functionality and up to the minute information of their entire pipeline with Amazon's Alexa voice control - making EVO the first and only appraisal management software to provide this capability in the mortgage industry.

FormFree selects Amazon Web Services (AWS) to power FormFree Exchange, a Hyperledger Fabric network

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced it has selected Amazon Web Services, Inc. (AWS) to power FormFree's consumer Financial DNA® solutions for the lender market. FormFree will leverage leading AWS technologies such as Amazon Managed Blockchain to create a scalable Hyperledger Fabric network.

Fintech Company, HomeBinder launches new features to strengthen the relationship between homeowners, home professionals, and mortgage lenders

BOSTON, Mass. /Massachusetts Newswire/ -- HomeBinder, a centralized home management platform that keeps homeowners connected with mortgage lenders, home inspectors, insurance providers, home pros, real estate agents, and other authorized professionals, today announced the release of new features and user interface (UI) improvements designed to enhance the home management experience.

Fintech Leader SimpleNexus announces it will be acquiring LBA Ware

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced its acquisition of Macon, Georgia-based software firm LBA Ware™. The strategic transaction, SimpleNexus' first, brings together 325 employees in 29 states to serve 425 distinct lender customers and dozens of mortgage technology integration partners.

FormFree CEO Brent Chandler releases statement commending Fannie Mae’s efforts to remove barriers to homeownership

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree Founder and CEO Brent Chandler today released a statement commending Fannie Mae's efforts to remove barriers to homeownership by adding a positive rent payment history feature to Desktop Underwriter® (DU®).

MBA Annual21: SimpleNexus debuts in-app payments with Nexus Pay

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced the debut of Nexus Pay at the Mortgage Bankers Association's Annual Convention and Expo (MBA Annual21) happening October 17-20 at the San Diego Convention Center.

Lender Price Receives Strategic Investment Led by Argentum to Support Rapid Growth in Fintech Sector

PASADENA, Calif. /Massachusetts Newswire - National News/ -- Lender Price, a leading provider of cloud-based mortgage pricing and digital lending solutions, announced today that it has received a strategic investment led by Argentum with participation from First Analysis and existing investor Costner Lake Investments. The investment will further accelerate Lender Price's rapid growth by supporting product development, sales & marketing, and customer service capabilities.

Mortgage Capital Trading (MCT) Deepens MSR Expertise with Hire of Azad Rafat

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- Mortgage Capital Trading, Inc. (MCT), a leading mortgage hedge advisory and secondary marketing software firm, announced today that Azad Rafat has joined the company as the new Senior Director of MSR Services.

SimpleNexus fintech homeownership platform’s user base has ballooned 48% since January 2021

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced new milestones in the company's bid to "build the future of mortgages."

Fintech Innovator DocMagic Launches eSign 3.0 to Enhance Remote Notary and eClosing

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of fully compliant loan document preparation, automated regulatory compliance, and comprehensive eMortgage services, announced the official launch of its eSign 3.0 platform. The enhancements to the mortgage industry's preeminent eSigning platform introduce new tools and features designed to enable lenders to easily facilitate remote online notarization (RON) for paperless eClosings.

Fintech innovator, Agile Launches MBS Pool Bidding for Mortgage Lenders

PHILADELPHIA, Pa. /Massachusetts Newswire - National News/ -- Agile, a groundbreaking fintech bringing mortgage lenders and broker dealers on to a single electronic platform, today announced the launch of MBS pool bidding, enabling lenders and dealers to gain much-needed efficiencies and data through technology.

Mortgage compliance expert Lyndal McLaughlin joins the LBA Ware CompenSafe team

MACON, Ga. /Massachusetts Newswire - National News/ -- LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today announced that mortgage industry expert Lyndal McLaughlin has joined its team as a software implementation consultant.

SimpleNexus announced integration of its Nexus Closing™ eMortgage solution with DocMagic’s eVault

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced the integration of its Nexus Closing™ eMortgage solution with DocMagic's eVault and eNote technologies. The integration enables automated generation of an eNote with a tamper-evident seal and delivers the eNote to a secure eVault for delivery to the MERS® eRegistry.

Promontory MortgagePath Adds Helen Placente as Managing Director of National Credit Operations

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced two key staffing changes expanding the strength of its executive team. Bryan DeShasier has been promoted to Chief Administrative Officer (CAO), and Helen Placente has been hired as Managing Director of National Credit Operations.

Mortgage Coach partners with LoanSense to help federal student loan holders become homeowners

CORONA, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, the industry's leading platform enabling mortgage lenders to create digital and accurate home loan options for consumers, today announced its partnership with LoanSense, an online student loan advisor that helps federal student loan holders enroll in affordable repayment and forgiveness plans.

LBA Ware LimeGear integrates with Experience.com to turn customer satisfaction scores into actionable business intelligence

MACON, Ga. /Massachusetts Newswire - National News/ -- LBA Ware™, a leading provider of incentive compensation management (ICM) and business intelligence (BI) software solutions for the mortgage industry, today announced it has partnered with Experience.com, home of the world's most impactful Experience Management Platform (XMP), to provide customers with a dynamic way to track customer satisfaction as a key performance indicator (KPI) in LBA Ware's LimeGear™ BI platform.

Agile, a new fintech bringing mortgage lenders and broker dealers on to a single electronic platform, launches RFQ Platform

PHILADELPHIA, Pa. /Massachusetts Newswire - National News/ -- Agile, a new fintech bringing mortgage lenders and broker dealers on to a single electronic platform, has formally announced the launch of its flagship RFQ (request for quote) platform. All MBS market participants can now participate on an electronic platform that expedites the exchange of To-Be-Announced Mortgage-Backed Securities (TBAs).

HousingWire 2021 HW Insiders Award List: Mortgage Capital Trading’s Paul Yarbrough Honored

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), an industry-leading mortgage hedge advisory firm, announced that Paul Yarbrough, Director of the Client Success Group, has been named to HousingWire's 2021 Insider Awards list. The list is designed to honor an organization's operational all-stars - those insiders who are the company's best-kept secret, yet vital to its success.

Fannie Mae and Freddie Mac certify SimpleNexus as eClosing solution provider

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, is now a Fannie Mae- and Freddie Mac-reviewed eClosing solution provider. The designation affirms that SimpleNexus' Nexus Closing™ eMortgage solution meets both GSEs' technical requirements for eClosing, eNote and eVault functionality and has been tested for compatibility with the GSEs' respective eNote delivery systems.

TMC Emerging Technology Fund LP leads $2.2M in pre-Series A round for AI-tech platform, Home Lending Pal

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently led a pre-Series A investment round in Home Lending Pal, a technology-enabled marketplace .

DocMagic Named to Inc. 5000 2021 List of Fastest-Growing Private Companies

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of fully compliant loan document preparation, automated regulatory compliance, and comprehensive eMortgage services, announced that it has been named to the 2021 Inc. 5000 list, the most prestigious ranking of the fastest-growing private companies in the country.

Fintech Company, Nomis, Introduces Margin Setter Dashboard in Latest Product Update

SAN FRANCISCO, Calif. /Massachusetts Newswire - National News/ -- Nomis Solutions (Nomis), a global, industry-leading pricing and profitability management solutions provider, recently introduced several product enhancements to its mortgage technology solution, further enhancing the market intelligence and actionable pricing capabilities available to its mortgage lending clients.

Knowledge Coop, the industry’s top virtual work platform, hires Brian Paine as Director of Technology

VANCOUVER, Wash. /Massachusetts Newswire - National News/ -- Knowledge Coop, the industry's top online compliance training and virtual work platform, today announced it has hired Brian Paine as Director of Technology. His responsibilities at Knowledge Coop include maintaining a stable working environment for all of Knowledge Coop's technical operations.

Maxwell named the 15th fastest-growing software company in the country on 2021 Inc. 5000

DENVER, Colo. /Massachusetts Newswire - National News/ -- Inc. magazine today revealed that Maxwell ranks in the top 3% of its annual Inc. 5000 list of fastest-growing private companies at number 154. Maxwell was also named the 15th fastest-growing software company in the country.

Sales Boomerang is ranked No. 101 on INC. 5000 2021 fastest-growing company lineup

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, debuted this week on Inc. magazine's Inc. 5000 list, an annual ranking of America's fastest-growing private companies. Sales Boomerang ranked #101 overall, placing the company among the top 3% of all private companies in America based on three-year revenue growth of 3,882% and outpacing every other company in the residential mortgage industry.

DocMagic, Inc. has promoted Chris Lewis to Director of Enterprise Solutions

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of fully-compliant loan document preparation, automated regulatory compliance, and comprehensive eMortgage services, announced that it has promoted Chris Lewis to Director of Enterprise Solutions. The new title reflects the elevated role he has proactively taken at the company in increasing revenue, forging strategic partnerships, and making inroads with large entities and marquee accounts.

Leading Digital Mortgage Platform Maxwell Named a 2021 Best Place to Work

DENVER, Colo. /Massachusetts Newswire - National News/ -- Maxwell, a leading digital mortgage and fulfillment platform for small to midsize lenders, just announced it was named a 2021 Best Place to Work by Denver Business Journal. The company ranked sixth in the medium-sized category.

FormFree enters into agreement with Lenders One to offer fintech products to member base

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced it has entered into an agreement with Lenders One®, a national alliance of independent mortgage bankers and service providers, to offer its product set to the Lenders One Mortgage Cooperative. Through the relationship, FormFree will offer Lenders One members access to automated borrower verification tools that enhance the customer experience and optimize lender business operations.

NotaryCam and RUTH RUHL, P.C. partner to offer Remote Online Notarization to Loss Mitigation Services

NEWPORT BEACH, Calif. /Massachusetts Newswire - National News/ -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization and identity verification / authentication technology for real estate and legal transactions, today announced it has partnered with RUTH RUHL, P.C., a Texas-based law firm, to add security and automation to the firm's loss mitigation services through remote online notarization (RON).

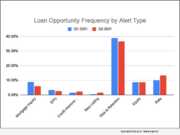

New report from Sales Boomerang highlights today’s areas of greatest mortgage lending opportunity in Q2 2021

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system, today released its inaugural Mortgage Market Opportunities Report. According to the report, refinance opportunities continue to dominate the market, but a promising uptick in new listings was also evident in the Q2 data. Mortgage servicers will need to closely manage their default and foreclosure risk in the coming months, as the second quarter saw nearly two out of five customers trigger a risk-and-retention alert.

SimpleNexus expands its C-suite under CEO Cathleen Schreiner Gates’ leadership

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced new executive appointments in operations, revenue generation and customer success.

Fintech News: Oklahoma Bankers Association Endorses Promontory MortgagePath’s Mortgage Fulfillment Services

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today the Oklahoma Bankers Association (OBA) has officially endorsed its mortgage fulfillment services and proprietary point-of-sale technology Borrower Wallet®.

FormFree has partnered with ICE Mortgage Technology, part of Intercontinental Exchange, Inc. (NYSE: ICE)

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® has partnered with ICE Mortgage Technology™, part of Intercontinental Exchange, Inc. (NYSE: ICE), a leading global provider of data, technology and market infrastructure, to make its AccountChek 3n1 asset, income and employment verification service available in Encompass®, the mortgage industry's leading cloud-based loan origination platform.

Jonas Kruckeberg named as director of growth and client success at MobilityRE

SALT LAKE CITY, Utah /Massachusetts Newswire - National News/ -- MobilityRE, a leader in real estate intelligence technologies for mortgage lenders and real estate agents, today announced it has appointed mortgage technology leader Jonas Kruckeberg as director of growth and client success.

Fintech News: SimpleNexus integrates with Finicity Mortgage Verification Service

LEHI, Utah /Massachusetts Newswire - National News/ -- SimpleNexus, developer of the leading homeownership platform for loan officers, borrowers, real estate agents and settlement agents, today announced an integration with Finicity's Mortgage Verification Service (MVS) that allows lenders to streamline the verification of applicants' assets, income and employment using a single embedded service.

Fintech News: Maxwell Launches MaxDiligence, a Tech-Powered Due Diligence and Quality Control Service for Lenders

DENVER, Colo. /Massachusetts Newswire - National News/ -- Today, leading digital mortgage platform Maxwell released MaxDiligence, a new offering that provides Due Diligence and Quality Control services for its clients. The latest feature in Maxwell's suite of tools designed for community lenders, MaxDiligence is a new scalable way to gain efficiency and generate reliable results.