New report highlights today’s areas of greatest mortgage lending opportunity

WASHINGTON, D.C. /Massachusetts Newswire – National News/ — Sales Boomerang, the mortgage industry’s top-rated automated borrower intelligence and retention system, today released its inaugural Mortgage Market Opportunities Report. According to the report, refinance opportunities continue to dominate the market, but a promising uptick in new listings was also evident in the Q2 data. Mortgage servicers will need to closely manage their default and foreclosure risk in the coming months, as the second quarter saw nearly two out of five customers trigger a risk-and-retention alert.

Methodology

The Mortgage Market Opportunities Report draws on Sales Boomerang system data to identify market opportunities of relevance to today’s borrowers and lenders. To generate the report, Sales Boomerang reviewed data from more than 125 residential mortgage lenders that use its borrower intelligence and retention tools to monitor millions of customer and prospect records. Sales Boomerang then calculated the aggregate frequency with which those contact records triggered loan-opportunity and risk-and-retention alerts during the first and second quarters of 2021.

Key Findings*

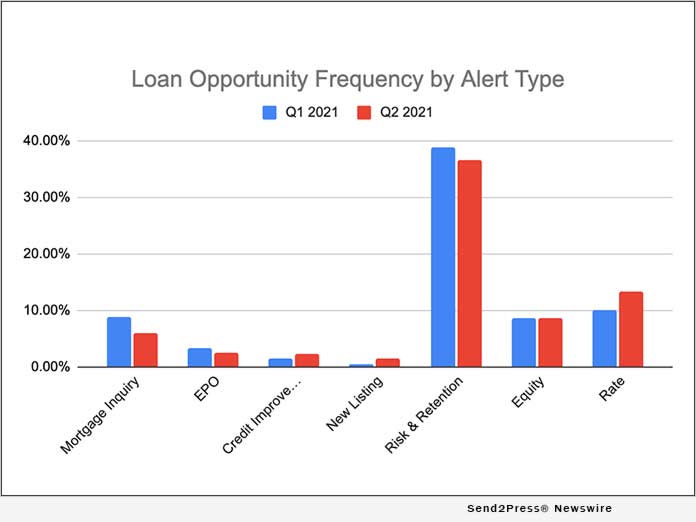

Across the sample group, the frequency of each alert type in Q2 2021 was as follows:

* Mortgage Inquiry Alert: 5.87% of monitored contacts (down 33.97% from Q1)

A customer or prospect has shopped with a competitor in the last 24 hours.

* EPO Alert: 2.43% of monitored contacts (down 24.30% from Q1)

A customer or prospect whose loan closed ≤ 6 months ago has shopped with a competitor in the last 24 hours.

* Credit Improvement Alert: 2.20% of monitored contacts (up 41.94% from Q1)

A customer or prospect has improved their FICO score.

* New Listing Alert: 1.37% of monitored contacts (up 163.46% from Q1)

A customer or prospect has listed their home for sale.

* Equity Alert: 8.55% of monitored contacts (down 0.70% from Q1)

A customer or prospect’s home equity has increased.

* Rate Alert: 13.33% of monitored contacts (up 31.85% from Q1)

The interest rate of a customer or prospect’s existing mortgage is significantly higher than current prevailing rates.

For a subset of lenders that maintain servicing portfolios, the frequency of risk-and-retention alerts was as follows:

* Risk & Retention Alert: 36.63% of monitored contacts (down 5.69% from Q1)

A customer is engaging in one or more of 15 credit activities that may put their serviced loan at risk.

Analysis*

* Though New Listing alerts occurred in less than 2% of the sample data set, this alert type also saw the greatest quarter-over-quarter growth (163%). With home listings on the rise, we may be seeing the first signs of the purchase market’s long-awaited reawakening.

* Refi opportunities continue to bear fruit; thanks to continued low interest rates, more than 13% of all contacts in the sample data set triggered a Rate alert in Q2, a 32% improvement over the previous quarter. But with Mortgage Inquiry alerts down nearly 34% quarter-over-quarter, lenders may need to proactively reach out to potential refi customers who aren’t shopping for rates with the same gusto as they were at the beginning of the year.

* Equity alerts remained steady quarter-over-quarter, triggering for about 1 in 12 contacts (9%) in the sample data set.

* Risk & Retention was the most frequently triggered alert across the sample data set (37%). This result may be partially attributable to the sensitive nature of the Risk & Retention alert, which is triggered by any of 15 consumer behaviors that place a borrower in danger of missing a mortgage payment. The high frequency of this alert also underscores the nation’s uneven economic recovery in the wake of the coronavirus pandemic, as more than 9.5 million people remain unemployed and around 2.5 million homeowners are in forbearance plans.

“Industry experts have been pushing the idea that the refinance market has dried up since early 2021, but our data shows that plenty of borrowers still have the opportunity to improve their rates,” said Sales Boomerang CEO Alex Kutsishin. “Meanwhile, the housing inventory shortages that have stymied the purchase market’s potential may finally be turning a corner, as our customers saw significant gains in new listings in Q2.”

*Key findings and analysis provided for informational purposes only. The data represented in the Mortgage Market Opportunities report is historical. Past performance is not a reliable indicator of future results. Sales Boomerang accepts no responsibility or liability for readers’ use of the key findings or analysis included in this report.

About Sales Boomerang:

Sales Boomerang transformed the relationship between mortgage lenders and borrowers with the introduction of the first automated borrower intelligence system in 2017. The company’s intelligent alerts notify lenders as soon as a past customer or prospect is ready and credit-qualified for a loan. As the mortgage industry’s #1 borrower retention tool, Sales Boomerang is trusted by more than 125 lenders – including brokers, independent mortgage companies, credit unions and banks – to help build lasting borrower relationships that maximize lifetime customer value. To date, Sales Boomerang alerts have enabled lenders to close more than $30 billion in additional loan volume that would have otherwise been overlooked and achieve customer retention rates that outperform industry norms by an average of 3-5X. To learn more about Sales Boomerang and its No Borrower Left Behind(tm) ethos, visit https://www.salesboomerang.com.

@SalesBoomerang

Learn More: https://www.salesboomerang.com/

This version of news story was published on and is Copr. © 2021 Massachusetts Newswire™ (MassachusettsNewswire.com) – part of the Neotrope® News Network, USA – all rights reserved.

Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website.