Tag: Taxes and Accounting

Tax Revolution 2.0: New Book by Rich Germaine Explores Public Support for the Replacement of the Current Income Tax System

SEATTLE, Wash. /Massachusetts Newswire: -- It's been 250 years since the first tax revolution. Media Arts Institute, a Seattle-based media company, has just released a new book, "Tax Revolution 2.0, Let's Get Rid of the Income Tax" (ISBN: 979-8288643385; paper) by media consultant and researcher Rich Germaine.

IRS Solutions, the trusted name in tax resolution software, announces its latest innovation, the Discrepancy Report

VALENCIA, Calif. /Massachusetts Newswire: -- IRS Solutions®, the trusted name in tax resolution software, announces the launch of its latest innovation, the Discrepancy Report. This cutting-edge feature is designed to simplify the detection of discrepancies between filed tax returns and income data reported to the IRS by third parties. This will empower tax professionals to prevent audits while delivering exceptional service to their clients proactively.

IRS Solutions Software Named as ASTPS Partner

VALENCIA, Calif. /Massachusetts Newswire: -- IRS Solutions®, a company offering innovative tax resolution software explicitly designed for tax professionals, announces that it has been named an industry partner by the prestigious American Society of Tax Problem Solvers (ASTPS).

MileageWise is the first company to announce offering lifetime plans for mileage tracking

SARASOTA, Fla. /Massachusetts Newswire: -- MileageWise is the first company to announce offering lifetime plans for mileage tracking, catering to long-term users. By eliminating monthly or yearly fees, users can significantly reduce software costs over time. Mileage tracker apps have become indispensable for ensuring tax compliance, minimizing audit risks, and maximizing deductions.

EnergyCAP Named a Leader for 2025 Data Quadrant Report by Info-Tech Research Group

STATE COLLEGE, Pa. /Massachusetts Newswire: -- Global research and advisory firm, Info-Tech Research Group, has identified EnergyCAP as the #1 overall Champion in its 2025 Data Quadrant Report. The report findings are based on data from user reviews on the firm's SoftwareReviews platform, the leading source for insights on the software provider landscape. EnergyCAP is a leading provider of utility bill management and energy tracking software designed to help organizations reduce energy consumption and costs.

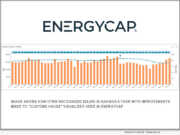

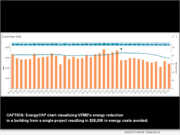

EnergyCAP Energy and Sustainability Software Helps AFL Global Automate Energy Management

BOALSBURG, Pa. /Massachusetts Newswire: -- AFL Global, a global leader in telecommunications and fiber optic solutions, has achieved a significant sustainability milestone by leveraging EnergyCAP, a leading energy and sustainability software platform. By implementing EnergyCAP, AFL Global has automated the management of nearly two-hundred utility accounts, which has enabled $304,000 in anticipated annual energy and utility cost savings and substantial environmental gains.

IRS Advance Notice by IRS Solutions Named as CPA Practice Advisor 2024 Tax and Technology Innovation Award Finalist

VALENCIA, Calif. /Massachusetts Newswire - National News/ -- IRS Solutions® announces that its cutting-edge feature, IRS Advance Notice™ (IAN), has been named a finalist for the CPA Practice Advisor 2024 Tax and Technology Innovation Award. The revolutionary new technology tracks and alerts their members to IRS transcript changes, streamlining tax resolution, improving client service, and offering steady, year-round income for tax professionals.

PitBullTax Software Ranked on the 2024 Inc. 5000 List of Fastest-Growing Private Companies, Third Year in a Row

CORAL SPRINGS, Fla. /Massachusetts Newswire - National News/ -- PitBullTax Software, the Nation's Leading Tax Resolution Software for CPAs, EAs and Tax Attorneys has revealed it has won a spot on the 2024 Inc. 5000 list of the fastest growing private companies in America for the 3nd year in a row. PitBullTax Software has licensees in all 50 states that rely on the company's software to prepare their clients' IRS resolution cases.

Allie Petrova, Tax Attorney, Among ‘Nation’s Best’ 2024 by Chambers USA

GREENSBORO, N.C. /Massachusetts Newswire - National News/ -- Petrova Law, a boutique tax law firm, which represents high net worth clients and companies nationwide, has been ranked by Chambers USA among the nation's best for its work on complex and high-stakes tax law matters.

Shawn Lankton appointed as CEO at EnergyCAP

BOALSBURG, Pa. /Massachusetts Newswire - National News/ -- EnergyCAP, the leading provider of energy and sustainability enterprise resource planning (ERP) software, today announced the appointment of Shawn Lankton as Chief Executive Officer. This decision reflects the Board's continued and growing optimism across the spectrum of growth opportunities ahead for EnergyCAP.

Asset Defense Team and Vast Solutions Group Launch New 2024 Joint Venture for Asset Protection and Tax Strategy

SEATTLE, Wash. /Massachusetts Newswire - National News/ -- Asset Defense Team and Vast Solutions Group (VastSolutionsGroup.com) are pleased to announce their joint venture, VastAssetDefense.com. This partnership brings together two leading companies in the asset protection and tax strategy industry, combining their expertise and resources to provide top-quality services to clients around the globe. The alliance is introducing an advanced AI platform called "Einstein" and is currently in Beta 4.0 and is also introducing a community called Vast Vault.

EnergyCAP has been named a Market Leader in the Energy Management Software category Summer 2024

STATE COLLEGE, Pa. /Massachusetts Newswire - National News/ -- EnergyCAP has been named a Market Leader in the Energy Management Software category for the Summer 2024 Customer Success Report published by FeaturedCustomers. FeaturedCustomers is the leading customer success content marketing platform for B2B business software & services helping potential B2B buyers make informed purchasing decisions through vendor validated customer success content.

London’s Garden Studios Bills Tenants and Identifies Energy Waste with EnergyCAP SaaS

STATE COLLEGE, Pa. /Massachusetts Newswire - National News/ -- Garden Studios, an innovative film studio based in London, has transformed its utility management and billing processes by implementing EnergyCAP's leading energy management platform. This move aligns with Garden Studio's commitment to sustainability as a certified B Corporation, dedicated to responsible business practices.

KROST CPAs in Los Angeles Acts as Exclusive Financial Advisor to United Filters International in its Sale to ENPRESS LLC

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- United Filters International (UFI), a recognized leader in the design and manufacture of an expansive range of liquid filtration solutions, was recently sold to ENPRESS LLC, a leading manufacturer of composite pressure vessels and water filtration technologies. KROST was the exclusive financial advisor, and the terms of the transaction were not disclosed.

EnergyCAP inaugural Eco Champion Award Winners from 2023 Announced

STATE COLLEGE, Pa. /Massachusetts Newswire - National News/ -- In the inaugural EnergyCAP Eco Champion Awards, leaders in sustainability and energy efficiency were celebrated across a diverse range of industries and use cases. All awards are based on submissions from the 2023 calendar year. EnergyCAP is a leading provider of energy and sustainability enterprise resource planning (ERP) solutions.

Accounting Today names KROST CPAs in Los Angeles to Top 100 Firm and Regional Leader 2024 list

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- For the fourth year in a row, Accounting Today has named KROST a Top 100 Firm. The firm ranked 82nd on the list by continuing to expand its services. In addition, KROST has once again earned the title of Regional Leader for the second year in a row, marking its third recognition in this category. From receiving these accolades to celebrating its 85th anniversary this year, KROST has reached another milestone in 2024.

EnergyCAP proudly announces that it has been awarded a coveted Top Product of the Year Award in the Environment+Energy Leader Awards

STATE COLLEGE, Pa. /Massachusetts Newswire - National News/ -- EnergyCAP proudly announces that it has been awarded a coveted Top Product of the Year Award in the Environment+Energy Leader Awards program. This year marks a milestone as the program divides accolades into six innovative categories, tailoring recognition to specific sustainability and energy management excellence sectors. EnergyCAP's suite of solutions, UtilityManagement™, CarbonHub™, and SmartAnalytics™, together earned a top spot in the Software & Cloud category.

Informative Research announces integration of Veri-Tax, the market leader in delivering the industry’s fastest verifications

GARDEN GROVE, Calif. /Massachusetts Newswire - National News/ -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced the integration of Veri-Tax, the market leader in delivering the industry's fastest verifications, into its proprietary Verification Platform. The integration merges Informative Research's platform with Veri-Tax's verification services so lenders can access advanced validation tools that elevate the accuracy and reliability of borrower information.

James Cha, CPA, Alerts Delinquent Taxpayers as IRS Intensifies Collection Efforts and Audit Activities for 2024

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- James Cha, a CPA and a Certified Tax Resolution Specialist from Ace Plus Tax Resolution, alerts that the IRS is ramping up collections and tax audits in 2024, and urges taxpayers to act with tax relief strategies. If you haven't received IRS notices recently about unfiled returns or unpaid taxes, expect that to change. The IRS is hiring more auditors and resuming collection notices aggressively. Be prepared for stepped-up IRS collections efforts in 2024.

Renowned tax attorney and national speaker Allie Petrova warns about new IRS tactics against taxpayers

GREENSBORO, N.C. /Massachusetts Newswire - National News/ -- It is official now: The Internal Revenue Service is going after high-income taxpayers who need to be filing returns, reporting income, and coming to terms with overdue taxes, penalties, and interest, cautions renowned tax attorney and national speaker Allie Petrova, founder of Petrova Law PLLC, a premier tax resolution law firm.

IRS Solutions Software Releases IRS Advance Notice (IAN) – Platform Tracks and Alerts Users to IRS Transcript Changes

VALENCIA, Calif. /Massachusetts Newswire - National News/ -- IRS Solutions® announces the addition of IRS Advance Notice™ (IAN) to the industry's favorite tax resolution platform. The new feature detects and alerts tax professionals to changes on client IRS transcripts, often months in advance of official notification by mail. CPAs, Enrolled Agents, Attorneys and other tax specialists can work less, earn more, and enjoy steady year-round income with IAN.

KROST CPAs and Consultants has been named one of the Top 150 Firms for 2023-2024 by CalCPA

PASADENA, Calif. /Massachusetts Newswire - National News/ -- KROST CPAs and Consultants has been named one of the Top 150 Firms for 2023-2024 by CalCPA. This award recognizes the firm, with 100% membership. The company is ranked 33rd on the list. The recognition reflects KROST's dedication to professional development and the CalCPA organization.

EnergyCAP Recognized as a Leader in Energy Management Software 2023 by Verdantix

BOALSBURG, Pa. /Massachusetts Newswire - National News/ -- EnergyCAP, a leading provider of energy and sustainability enterprise resource planning (ERP) software, proudly announces its prestigious placement in the top right leader quadrant of the Verdantix Green Quadrant: Energy Management Software 2023. This accolade underscores EnergyCAP's commitment to delivering innovative and effective solutions in the energy & sustainability management sector.

TMC Emerging Technology Fund Invests in Halcyon investment advisory, IRS transcripts and tax preparation services

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") has made its latest investment in Halcyon. Halcyon's suite of services provides financial institutions with a 360-degree financial relationship with its customers by affordably expanding their offerings to include investment advisory, IRS transcripts and tax preparation services.

KROST CPAs Ranked Among Top 100 Firms in the U.S. in 2023 by INSIDE Public Accounting

PASADENA, Calif. /Massachusetts Newswire - National News/ -- INSIDE Public Accounting (IPA) has named KROST CPAs & Consultants Top 100 Firm in 2023. The firm ranked 73rd on the prestigious Top 100 list. KROST along with other recipients of these distinguished awards are highlighted in IPA's monthly newsletter. KROST has been named Top 100 firm for the third year in a row.

Matthew Weber Promoted to Principal at KROST CPAs in Los Angeles

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- KROST, a leading CPA and consulting firm, is thrilled to announce the promotion of Matthew Weber to the esteemed position of Principal. Matthew's dedication, experience, and exceptional contributions have led to this well-deserved advancement within the organization.

PitBullTax Software included on the 2023 Inc. 5000 list of the fastest growing private companies for the 2nd year

CORAL SPRINGS, Fla. /Massachusetts Newswire - National News/ -- PitBullTax Software, the Nation's Leading Tax Resolution Software for CPAs, EAs and Tax Attorneys has revealed it has won a spot on the 2023 Inc. 5000 list of the fastest growing private companies in America for the second year in a row.

Avenu Insights Secures Major Win as Oxnard CA Chooses Them to Handle Critical SUTA Contract

OXNARD, Calif. /Massachusetts Newswire - National News/ -- Avenu Insights & Analytics (Avenu), the leading provider of software administration and revenue recovery solutions for state and local governments, has achieved a significant milestone with the award of a Sales & Use Tax Auditing (SUTA) contract by the City of Oxnard, California.

Walker Reid Strategies’ new division supports MEP firms, architects, engineers, ESCOS, and LEED professionals

BOCA RATON, Fla. /Massachusetts Newswire - National News/ -- Walker Reid Strategies, Inc. is proud to announce the launch of a new division that provides outsourcing engineering services. The division will support MEP firms, architects, engineers, ESCOS, and LEED professionals by supplementing labor shortages and reducing costs through energy modeling, BIM, and code compliance services.

University of Texas Medical Branch and University of New Mexico pursue decarbonization and unmatched energy efficiency with EnergyCAP solutions

STATE COLLEGE, Pa. /Massachusetts Newswire - National News/ -- EnergyCAP, a renowned provider of energy and sustainability enterprise resource planning (ERP) solutions, proudly announces The University of Texas Medical Branch (UTMB) and The University of New Mexico (UNM) have adopted EnergyCAP's newest solutions: CarbonHub and Wattics, making them the first customers to embrace EnergyCAP's complete solution suite.

Tax Help MD, Inc. Provides Five Steps to Help Small Corporations Calculate QBI in 2023

WEST PALM BEACH, Fla. /Massachusetts Newswire - National News/ -- Tax Help MD helps self-employed individuals and small businesses to resolve tax issues. From basic tax filings to more complex situations, Tax Help MD wants its clients to come out on top. That's why it empowers them with information, so they can get the best tax benefits available.

As State’s Premier Accounting Firm, JTC CPAs Takes Home Top Honors at Idaho’s Best Awards 2023

BOISE, Idaho /Massachusetts Newswire - National News/ -- JTC CPAs, a leading accounting firm based in Idaho, is thrilled to announce their recent award-winning recognition as the 2023 best accountant in both Treasure Valley and statewide in Idaho. Winning the 2023 Best CPA for Treasure Valley and Best Statewide Accountant in Idaho awards is a great achievement for JTC CPAs, and it reflects the firm's dedication to excellence in the field of accounting.

KROST CPAs named a 2023 Top 100 Firm and Regional Leader by Accounting Today

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- KROST has been recognized as a Top 100 Firm by Accounting Today for the third year in a row. The firm ranked 72nd with a 16.60% change in revenue from the previous year. In addition, KROST has also been named a Regional Leader of 2023. The firm recently launched a new service, KROST Fund Admin Solutions, to further assist and add value for their clients.

In Tax Court Case, Engineering Firm Overstated §179D Energy Efficient Commercial Building Property Deduction says ICS Tax, LLC

COLUMBUS, Ohio /Massachusetts Newswire - National News/ -- In a recent case, Michael Johnson, et ux. v. Commissioner, the tax court denied the majority of a taxpayer's Energy Efficient Commercial Building Deduction under IRC §179D since it claimed a §179D Deduction exceeding the cost of the Energy Efficient Commercial Building Property (EECBP), says ICS Tax, LLC.

Avenu awarded contract by Honolulu to provide tax administration for Honolulu’s Transient Accommodations Tax

HONOLULU, Hawaii /Massachusetts Newswire - National News/ -- Avenu Insights & Analytics (Avenu) is pleased to announce that it has been awarded a contract by the City and County of Honolulu to provide tax administration for transient accommodations tax (TAT), an important revenue source for the agency and its citizens.

Grant K. Miller, CPA, EA, joins KROST CPAs in Los Angeles, as Principal of Tax

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- Los Angeles-based CPA firm, KROST CPAs & Consultants, welcomes Grant K. Miller, CPA, EA, as Principal of Tax. To begin his new role as Tax Principal, Grant will be based in our Woodland Hills office and he will provide direction and leadership to further the success of our tax department. He will also work closely with clients to manage their expectations for deliverables, services, and budgets.

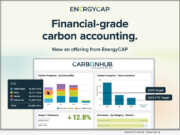

EnergyCAP’s newest solution, CarbonHub, serves as the central repository of all carbon emissions related data, sustainability reporting, and tracking performance

BOALSBURG, Pa., /Massachusetts Newswire - National News/ -- EnergyCAP, a leading provider of energy and sustainability enterprise resource planning (ERP) software, today announced the launch of CarbonHub, a new solution that offers financial-grade carbon accounting and sustainability reporting.

Vast Solutions Group, Inc. and Asset Defense Team Launch Joint Venture for 2023

SEATTLE, Wash. /Massachusetts Newswire - National News/ -- Asset Defense Team and Vast Solutions Group, Inc. are pleased to announce their joint venture, AssetDefenseAdv.com. This partnership brings together two leading companies in the asset protection and tax strategy industry, combining their expertise and resources to provide top-quality services to clients around the globe. The advanced platform is called "Einstein" and is currently in Beta 1.0.

New guidance for plan sponsors as they seek to comply with landmark SECURE 2.0 legislation

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- Independent, full-service employee benefits consulting firm Strategic Benefits Advisors, Inc. (SBA) issued a statement today outlining provisions of the newly enacted SECURE 2.0 Act of 2022 (SECURE 2.0) that are likely to affect most medium to large retirement plan sponsors.

Online CPA courses to prepare students for the US CPA exams launched by Maxwell CPA Review LLC

ORLANDO, Fla. /Massachusetts Newswire - National News/ -- A new exam-prep company is helping students to pass the U.S. CPA exams in droves. Maxwell CPA Review was founded by Kyle Ashcraft, CPA and provides online CPA courses to prepare students for the U.S. CPA exams. Kyle passed all four CPA exams with a 90 and above, in only six months. Now he works to equip students with the same tools that prepared him for his exams.

Absolute Trust Academy trust administration 101 continuing education event will examine procedures and preparedness protocols to enhance practice efficiencies

WALNUT CREEK, Calif. /Massachusetts Newswire - National News/ -- Leading Bay Area estate planning firm Absolute Trust Counsel will host a free virtual event, The Absolute Trust Academy Trust Administration 101, on October 28, 2022, to equip CPAs and CFPs with a stronger knowledge of trust administration processes. The webinar is aimed at enhancing advisors' client services and relationships.

KROST CPAs in L.A. acted as the exclusive financial advisor to American Range in its transaction to Hatco Corporation

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- American Range, a privately held manufacturer of commercial and residential cooking appliances, was sold to Hatco, an employee-owned manufacturer of warming, cooking, sanitizing, and cooling equipment. KROST CPAs & Consultants acted as the exclusive financial advisor to American Range in its transaction to Hatco Corporation.

For 2022, INSIDE Public Accounting Names KROST Best of the Best Firm and Top 100 Firm

PASADENA, Calif. /Massachusetts Newswire - National News/ -- KROST CPAs & Consultants was recognized as the Best of the Best Firm and Top 100 Firm by INSIDE Public Accounting in 2022. Based on revenue, KROST was ranked 75th among the largest firms in the country, out of nearly 600 firms. With a net revenue of greater than $65 million, KROST was able to rise from the firm's previous ranking of 81st in 2021's IPA Survey and Analysis of Firms.

Jonathan Louie & Matthew Weber Appointed to the KROST ‘Principal in Development Program’

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- Los Angeles-based CPA firm, KROST CPAs & Consultants, appoints Matthew Weber, CPA, MAcc, and Jonathan Louie, CPA, MST, to join KROST's Principal in Development (PID) program.

PitBullTax Software Named one of the Fastest Growing Private Companies in America on the 2022 INC 5000

CORAL SPRINGS, Fla. /Massachusetts Newswire - National News/ -- PitBullTax Software, the Nation's Leading Tax Resolution Software for CPAs, EAs and Tax Attorneys has revealed it has won a spot on the 2022 Inc. 5000 list of the fastest growing private companies in America.

KROST CPAs names Paren Knadjian as Principal of Mergers and Acquisitions, Capital Markets and Brad Pauley as Principal of Tax

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- Los Angeles-based CPA Firm, KROST CPAs and Consultants announced Paren Knadjian as Principal of M&A and Capital Markets and Brad Pauley as Principal of Tax. Knadjian has successfully completed over 200 M&A and Capital Markets transactions worth over $1 billion.

IRS Releases Updated Practice Unit for Auditing the 179D Energy Efficient Commercial Buildings Deduction says ICS Tax LLC

EGAN, Minn. /Massachusetts Newswire - National News/ -- The IRS Large Business and International (LB&I) Division released an updated Practice Unit for its agents to audit the 179D Energy Efficient Commercial Buildings Deduction (179D Deduction), ICS Tax, LLC announced today. It confirms that taxpayers can use the ASHRAE Standard 90.1-2007 rather than newer, more strict standards but also could be an indication that the IRS will have added scrutiny on 179D projects.

PitBullTax Software Integrates with Major Tech Companies to Further Dominate IRS Tax Resolution Solution Industry

CORAL SPRINGS, Fla. /Massachusetts Newswire - National News/ -- PitBullTax Software, the Nation's Leading IRS Tax Resolution Software for CPAs, EAs and Tax Attorneys has announced the release of Version 7.0. PitBullTax Software has licensees in all 50 states that rely on their software to prepare their clients' IRS resolution cases.

Dr. Velma Trayham Announced as Keynote Speaker for Takeaway Tax Business Conference in Houston, Texas

HOUSTON, Texas /Massachusetts Newswire - National News/ -- Highlighting the power of entrepreneurship to change the world and end poverty, award-winning B2B/diversity consultant and leader Dr. Velma Trayham (CEO of Thinkzilla Consulting Group) has been announced as the keynote speaker for TakeAway Tax's upcoming Tax Business Conference in Houston on Aug. 4.

The Importance of Integrity Within the Tax Consulting Industry in 2022, per ICS TAX LLC

SAVAGE, Minn. /Massachusetts Newswire - National News/ -- Choosing a tax consulting firm as a trusted advisor is an exceptionally important decision for both businesses needing such services as well as accounting firms who refer them to their clients, says ICS Tax, LLC.

KROST CPAs was recognized as Top 100 Firms for 2022 by Accounting Today

PASADENA, Calif. /Massachusetts Newswire - National News/ -- KROST was recognized as a Top 100 Firm by Accounting Today. The firm ranked 76th with a 18.08% change in revenue from last year. KROST has now been ranked in this prestigious list two years in a row. With new services on the horizon, KROST continues to develop ways to add value for their clients.

KROST Recognized by L.A. Business Journal as among Top 100 Accounting Firms for 2022

PASADENA, Calif. /Massachusetts Newswire - National News/ -- KROST was recognized as one of Los Angeles Business Journals' Top 100 Accounting Firms in Los Angeles County, with 78% growth in revenue between 2020 and 2019, the firm is ranked 22nd on the list. KROST received this recognition during the Los Angeles Business Journal's Disruptor Awards virtual event.

KROST CPAs names Greg Kniss Chairman of the Board, Jason Melillo CEO and Keith Hamasaki as Principal of Assurance and Advisory

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- Los Angeles-based CPA Firm, KROST CPAs and Consultants announced that Greg Kniss has been appointed to Chairman of the Board, Jason Melillo promoted as the new CEO, and Keith Hamasaki to Principal of Assurance & Advisory services.

KROST CPAs Posts Record Year of Mergers and Acquisitions Advisory in 2021

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- KROST CPAs and Consultants reported a record year of M&A advisory work in 2021 and expects to remain equally busy in 2022. "We were involved in 21 buy-side and sell-side transactions in 2021," said Paren Knadjian, Head of M&A and Capital Markets at KROST.

Energy Management Software firm, EnergyCAP Names Lalit Agarwal VP, Energy Management and Sustainability

STATE COLLEGE, Pa. /Massachusetts Newswire - National News/ -- EnergyCAP, LLC, the leading provider of energy management and utility bill processing software, today announced that Lalit Agarwal has been named Vice President, Energy Management & Sustainability.

ICS Tax, LLC notes IRS Mandates Additional Requirements for Research and Development Tax Credit Refund Claims in 2022

SAVAGE, Minn. /Massachusetts Newswire - National News/ -- In 2007, the IRS made the Research & Development (R&D) tax credit a Tier 1 issue, says ICS Tax, LLC (ICS). Tier 1 issues were those of high strategic importance that had a significant impact on one or more industries, essentially meaning that the IRS would audit taxpayers filing amended returns on such issues. To taxpayers' relief, the Tiered Issue Process was eliminated in 2012, effectively placing the R&D tax credit in the same audit pool as other issues.

Certa Partners with Comply Exchange, a global leader in tax compliance

SARATOGA, Calif. /Massachusetts Newswire - National News/ -- Certa, the leading no-code third party risk management platform today announced its integration with Comply Exchange, a global leader in tax compliance. Certa is the only platform that digitizes, orchestrates, and automates the entire third-party journey across procurement, compliance, IT, legal, finance, and other groups.

Thomas R. Patterson, Jr. named new CEO at EnergyCAP

BOALSBURG, Pa. /Massachusetts Newswire - National News/ -- EnergyCAP, LLC (ENC), the leading provider of data and analytics software for energy and utility bill management, today announced that Thomas R. Patterson, Jr. (Tom) has been named as Chief Executive Officer (CEO) of the company. Steve Heinz, who founded the company in 1982, will retire from his role as CEO but will continue in an advisory capacity as a member of the Board of Directors.

In Montgomery, Alabama, Adam Finesilver, CPA joins ICS Tax LLC as its Regional Director

MONTGOMERY, Ala. /Massachusetts Newswire - National News/ -- ICS Tax, LLC is excited to announce its Southeast regional expansion with a new office in Montgomery, Alabama. ICS welcomes Adam Finesilver, CPA as its Regional Director. Adam brings over 13 years of experience providing tax advisory services to clients in real estate, financial and professional services industries.

Integrity Bio, Inc. sold to Curia – formerly Albany Molecular Research, Inc.

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- Integrity Bio, Inc., a privately held formulation and fill-finish organization, was sold to Curia (formerly Albany Molecular Research, Inc. (AMRI)), a Contract Development and Manufacturing Organization (CDMO) and leading global provider of advanced contract research, development, and manufacturing solutions. KROST, a Los Angeles-based firm, acted as the exclusive financial advisor to Integrity Bio in the transaction.

AICPA recertifies Fanplayr’s processes to safeguard sensitive customer data

PALO ALTO, Calif. /Massachusetts Newswire - National News/ -- Fanplayr, a global leader in online behavioral personalization, artificial intelligence and user privacy, announces it has successfully achieved the Service Organization Control (SOC) 2 Type 2 certification.

James Cha, CPA in Los Angeles, notes that IRS Collection is Now Back and Sending Final Intent to Levy Notices

LOS ANGELES, Calif. /Massachusetts Newswire - National News/ -- James Cha, a CPA and a Certified Tax Resolution Specialist from Ace Plus Tax Resolution, underlines that the IRS is starting its collection actions by sending Final Intent to Levy notices, and urges taxpayers to act with tax relief strategies.

Travis Mlodzik, Central Practice Leader for ICS Tax, LLC has been elected President of the ASCSP

SAVAGE, Minn. /Massachusetts Newswire - National News/ -- Travis Mlodzik, Central Practice Leader for ICS Tax, LLC has been elected President of the American Society of Cost Segregation Professionals (ASCSP). Cost Segregation is a tremendously valuable tax planning strategy for real estate investors. The ASCSP provides education, credentialing, and a code of ethics for its members while representing the very best professionals in the cost segregation industry.

AmTrav Corporate Travel and Emburse Automate Travel Expenses

AGOURA HILLS, Calif. /Massachusetts Newswire - National News/ -- AmTrav, the one connected platform for business travel, and Emburse, a global leader in expense management and accounts payable automation, today announced the next evolution in their partnership with the launch of their automatic receipts integration.

HomeWork Solutions and Mrs. LTC partner to Offer Long-Term Care Claim Processing for Household Employers

STERLING, Va. /Massachusetts Newswire - National News/ -- HomeWork Solutions (HWS), the industry expert in household payroll and employment taxes, has entered into an exclusive partnership agreement with Mrs. LTC, a leading provider of Long-Term Care Claims processing.