Tag: DepthPR

FormFree announced the integration of AccountChek with Solex

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced the integration of AccountChek®, a service that allows lenders to verify borrowers' assets, income, employment and rent payment history, with Solex®, a comprehensive eDelivery, eSign, eClose and eVault platform from Docutech®, a First American company.

Mobility Market Intelligence (MMI) ranks No. 11 on Utah Fast 50 list of fastest-growing companies

SALT LAKE CITY, Utah /Massachusetts Newswire - National News/ -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it ranks No. 11 on the 2022 Utah Business list of fastest growing companies in the state.

Fintech innovators FormFree and Finastra partner to streamlines borrower verification for improved mortgage loan processing

ATHENS, Ga. /Massachusetts Newswire - National News/ -- Finastra and FormFree®, a market-leading fintech company that enables lenders to understand people's true ability to pay (ATP®), have partnered to further streamline electronic borrower verification for mortgage lenders.

Vice Capital Markets is one of the first to release Freddie Mac Cash Purchase Statement API

NOVI, Mich. /Massachusetts Newswire - National News/ -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today that it is one of the first Freddie Mac-integrated Secondary Market Advisors (SMAs) to release an integration for Freddie Mac's Cash Settlement Purchase Statement application programming interface (API).

John Gust joins Digital Mortgage Tech Firm, Promontory MortgagePath, as Director of Product Management

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced industry veteran John Gust has joined the organization as the director of product management. In this role, Gust leads the product management and user experience teams and is responsible for product strategy, planning, execution, and rollout of Promontory MortgagePath's mortgage fulfillment services and end-to-end technology solution.

2022 Inc. 5000 list: Sales Boomerang named to list for second consecutive year

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced that the Sales Boomerang borrower intelligence solution made its second consecutive appearance on Inc.'s annual Inc. 5000 list.

Mortgage Tech Firm, Mobility Market Intelligence (MMI) debuts in top 1500 on the 2022 Inc. 5000 Annual List

SALT LAKE CITY, Utah /Massachusetts Newswire - National News/ -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it ranks No. 1499 on the 2022 Inc. 5000 list of the fastest-growing private companies in America. The list represents a one-of-a-kind look at the most successful companies within the economy's most dynamic segment-its independent businesses.

ACES Quality Management Executives selected to speak at MBA 2022 RMQA Conference

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced Executive Vice President of Compliance Amanda Phillips and Executive Vice President of Operations Sharon Reichhardt have been selected to speak at the upcoming Mortgage Bankers Association's (MBA) Risk Management, Quality Assurance and Fraud Prevention Forum (RMQA) taking place September 11-13 in Nashville, Tenn.

HomeScout and FormFree partnership to help lenders identify mortgage-ready borrowers earlier in home buying journey

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® has partnered with HomeScout, a wholly owned subsidiary of FirstClose®, to launch HomeScout Qualified Borrower, a tool that helps lenders generate leads and concentrate borrower conversion efforts on mortgage-ready home buyers.

ACES Quality Management software updated to align with recent mortgage quality control (QC) reporting recommendations issued by Fannie Mae

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that it has enhanced its reporting library within its flagship audit platform ACES Quality Management & Control® Software to help align with recent mortgage quality control (QC) reporting recommendations issued by Fannie Mae.

Mortgage Coach was implemented to provide Keller Mortgage borrowers with personalized mortgage advice supported by digital home loan presentations

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Keller Mortgage has made Mortgage Coach available to loan officers enterprise-wide.

2022 Sales and Marketing Technology Awards honor Sales Boomerang

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it was selected Organization of the Year in the Business Intelligence Group's 2022 Sales and Marketing Technology Awards program, also known as The Sammys.

National Mortgage Professional names Dave Savage to list of Most Connected Mortgage Pros

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced that Chief Innovation Officer Dave Savage was named to National Mortgage Professional's (NMP) 2022 list of Most Connected Mortgage Professionals.

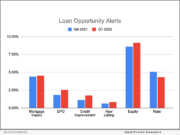

Mortgage Market Opportunities Report for Q2 2022 from Sales Boomerang

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. Sharp quarter-over-quarter increases in cash-out, credit-improvement and new-listing alerts in Q2 2022 point to areas of opportunity for lenders in a contracting mortgage market.

NotaryCam eClose360 update delivers a better user experience for both notaries and document signers

NEWPORT BEACH, Calif. /Massachusetts Newswire - National News/ -- NotaryCam®, the pioneering leader in online notarization and original provider of mortgage eClosing solutions, announced today that it has made updates to its eClose360® platform to expand its capabilities and deliver a better user experience for both notaries and document signers.

Q2 2022 Homeownership Program Index: More U.S. homebuyer assistance programs are introduced during a quarter of difficult conditions

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from its latest Homeownership Program Index (HPI). The firm's analysis of 2,273 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 1.6% from Q1 to Q2 2022.

Sales Boomerang announced the launch of its newest automated alert offering, Life Event Alerts

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the launch of its newest automated alert offering, Life Event Alerts, which notify mortgage advisors when a borrower or a prospect in their customer database experiences a major life change that could alter their financial situation and/or goals.

Promontory MortgagePath’s Louann Bernstone Named to 2022 Elite Women’s List by MPA

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced Louann Bernstone, managing director of vendor management, has been named to Mortgage Professional America's (MPA) sixth annual Elite Women list. This award recognizes successful women making waves and pushing boundaries in the traditionally male-dominated mortgage industry.

Click n’ Close promotes Daniel Forshey to COO and Sady Mauldin to Chief Compliance Officer

ADDISON, Texas /Massachusetts Newswire - National News/ -- Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, is pleased to announce the company has promoted Daniel Forshey to Chief Operating Officer and Sady Mauldin to Chief Compliance Officer.

Richard Grieser of Sales Boomerang named a 2022 Marketing Leader by HousingWire

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that Richard Grieser, vice president of marketing, was named to the prestigious 2022 HW Marketing Leaders List. This award, presented by HousingWire magazine, is presented to marketing leaders driving outsized business performance in the mortgage and real estate industries.

FormFree announces support for new Freddie Mac Loan Product Advisor enhancement is designed to expand sustainable homeownership

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® announced that mortgage lenders using AccountChek® verification of asset (VOA) reports in conjunction with a Freddie Mac Loan Product Advisor® (LPA℠) solution will soon benefit from an enhancement that takes loan applicants' 12-month on-time rent payment history into consideration when assessing eligibility for qualified first-time homebuyers.

iEmergent, a forecasting and advisory services firm, appoints Megan Horn as chief marketing officer (CMO)

DES MOINES, Iowa /Massachusetts Newswire - National News/ -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the appointment of Megan Horn as chief marketing officer (CMO). In this role, Horn will oversee marketing, public relations, brand management and customer experience for the growing company.

Ruoff Mortgage Selects ACES Quality Management to Improve Loan Quality Across Multiple Product Lines

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that Ruoff Mortgage Company, Inc. (Ruoff Mortgage), a full-service residential mortgage lender, has selected its flagship audit platform ACES Quality Management & Control® Software to support the company's origination and servicing quality control (QC) audits.

Sales Boomerang and Mortgage Coach Announce Merger and new CEO

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced their merger and the appointment of SaaS executive Richard Harris as CEO.

Mid America Mortgage rebrands as Click n’ Close, will focus on its reverse mortgage and Native American lending business

ADDISON, Texas /Massachusetts Newswire - National News/ -- Mid America Mortgage, Inc. (Mid America) today announced it has rebranded as Click n' Close following the sale of the majority of its retail lending operations to Houston-based Legend Lending. Click n' Close will retain retail operations related to its reverse mortgage and Native American lending business and focus on delivering innovative down payment assistance (DPA) and adjustable-rate mortgage (ARM) products through its third-party originator (TPO) channels.

Mid America Mortgage Announces it Now Offers eNotes to Non-Delegated Correspondents through its Wholesale Channel

ADDISON, Texas /Massachusetts Newswire - National News/ -- Mid America Mortgage, Inc. (Mid America) announced today it is offering eNotes capabilities via its wholesale channel to enable non-delegated correspondents to operate more efficiently and competitively as they make the transition from mortgage broker to banker. Through this program, third-party originators (TPOs) can deliver the convenience digital closings provide to their customers and enhance relationships with their existing real estate and title partners amidst an otherwise challenging operating environment.

TMC Emerging Technology Fund LP Invests in leadPops, a digital customer acquisition software firm

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- The Mortgage Collaborative (TMC), the nation's largest independent cooperative network serving the mortgage industry, announced today that the TMC Emerging Technology Fund LP (the "Fund") recently participated in a follow-on round to a recent $3.5M Series A completed by leadPops, a digital customer acquisition software and marketing innovation platform. leadPops allows users to create robust, automated lead-generating systems that drive qualified leads directly to their business.

Mortgage QC Industry Trends Report for Q4 2021 Shows Critical Defect Rate Rose to 1.95%

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and full calendar year (CY) of 2021. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

Mortgage Markets CUSO, LLC has implemented Mortgage Coach to grow mortgage lending engagement at the credit unions it serves

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Mortgage Markets CUSO, LLC has implemented Mortgage Coach to grow mortgage lending engagement at the credit unions it serves.

2022 ACES ENGAGE Event: ACES Quality Management Unveils Certified ACES Administrator Program

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the launch of its Certified ACES Administrator (CAA) program during its inaugural ACES ENGAGE event, held May 23-25, 2022 at the Broadmoor Hotel in Colorado Springs.

Down Payment Resource’s latest analysis finds that 33% of declined mortgage applications happen for reasons addressable with homebuyer assistance

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced findings from an analysis showing that a substantial share of mortgage loan applications are both declined for reasons that can be addressed with homebuyer assistance and eligible for homebuyer assistance programs.

Iowa-based iEmergent, a forecasting and advisory services firm, names Chris Richey as chief analytics officer

DES MOINES, Iowa /Massachusetts Newswire - National News/ -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, today announced the appointment of Chris Richey as chief analytics officer. In this role, Richey will oversee and expand upon iEmergent's data analytics capabilities, which help mortgage lenders identify gaps in sales coverage and effectively expand into new markets.

Sales Boomerang welcomes Cheryl Messner to oversee its customer experience department

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it has tapped Cheryl Messner to manage its customer experience departments. In her new role, Messner will define strategies to enhance Sales Boomerang's customer experience, engagement, success and operations as well as help the company build upon its growth from a fintech startup to the industry's leading borrower intelligence solution.

U.S. mortgage lenders now able to use FormFree AccountChek to satisfy Freddie Mac’s reverification of employment requirement

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that its AccountChek® digital asset verification service supports a new enhancement to Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution that makes assessment of borrower employment easier, faster, less expensive and more fraud-resistant.

MMI has ranked No. 29 on Inc. Magazine’s third annual Inc. 5000 Regionals: Rocky Mountains list

SALT LAKE CITY, Utah /Massachusetts Newswire - National News/ -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has ranked No. 29 on Inc. Magazine's third annual Inc. 5000 Regionals: Rocky Mountains list.

Down Payment Resource analysis finds that more than 13,000 OneKey MLS residential listings may be eligible for homeowner assistance programs

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- OneKey® MLS, the largest multiple listing service (MLS) in New York, today announced that it has partnered with Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, to indicate MLS residential listings that may be eligible for down payment assistance and other homebuyer affordability programs.

Mid America Mortgage promotes Gary D. McKiddy to CFO

ADDISON, Texas /Massachusetts Newswire - National News/ -- Mid America Mortgage, Inc. (Mid America) announced today that Gary D. McKiddy has been promoted from Chief Risk Officer to Chief Financial Officer. In this new role, McKiddy will manage financial operations and strategy as Mid America Mortgage continues to refine its operations and drive business growth through recent product line additions, such as its correspondent down payment assistance (DPA) program.

Down Payment Resource analysis finds that 63% of realMLS listings may be eligible for down payment assistance

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- realMLS, serving 11,000 members in Northeast Florida, today announced that it has partnered with Down Payment Resource (DPR) to enhance its platform with DPR's suite of real estate agent tools that help MLS customers connect homebuyers with homebuyer assistance programs.

David Bowser named VP, Customer Engagement at Mortgage Coach, Suzanne Duniphin named VP, Customer Experience

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced the advancement of two of its department directors to vice president-level positions. Suzanne Duniphin was promoted from director of eLearning to VP, customer experience, and David Bowser was promoted from director of account management to VP, customer engagement.

FormFree Heroes Golf Classic 2022 benefits the American Red Cross of Northeast Georgia

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree today announced it has opened registration to the organization's third annual Heroes Golf Classic, which will be held on September 9, 2022, at Lanier Islands Legacy Golf Course in Buford, Georgia. All proceeds from the event will be donated to the American Red Cross of Northeast Georgia, a 501(c)(3) nonprofit organization that provides emergency assistance and preparedness education to communities affected by disaster.

Mobility Market Intelligence (MMI) appoints Kortney Lane-Schafers as Regional Director of Growth

SALT LAKE CITY, Utah /Massachusetts Newswire - National News/ -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has hired Kortney Lane-Schafers as a regional director of growth. Lane-Schafers' responsibilities will include consulting and strategizing with MMI's growing roster of mortgage enterprise clients.

Sales Boomerang Co-founders Mark Cunningham and Alex Kutsishin named Entrepreneur Of The Year 2022 Mid-Atlantic Award finalists

BALTIMORE, Md. /Massachusetts Newswire - National News/ -- Ernst & Young LLP (EY US) today announced that Sales Boomerang co-founders Mark Cunningham, president, and Alex Kutsishin, CEO, were named finalists for the Entrepreneur Of The Year® 2022 Mid-Atlantic Award. Entrepreneur Of The Year is one of the preeminent competitive business awards for entrepreneurs and leaders of high-growth companies who think big to succeed.

Down Payment Resource’s homebuyer assistance search tool adopted by Realtor.com to support its Closing the Gap initiative

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced that Realtor.com® has deployed DPR's search tool that helps home shoppers find homebuyer assistance programs.

Logix Federal Credit Union chooses Mortgage Coach to enhance mortgage advisory service with interactive Total Cost Analysis loan presentations

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Logix Federal Credit Union (Logix) has rolled out Mortgage Coach to enhance the mortgage advisory service it provides to members.

Employee benefits consulting firm Strategic Benefits Advisors, Inc. (SBA) announced the firm is celebrating its 20th anniversary

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- Independent, full-service employee benefits consulting firm Strategic Benefits Advisors, Inc. (SBA) announced the firm is celebrating its 20th anniversary. Since opening its doors in April 2002, SBA has helped organizations in every sector of the North American economy navigate their toughest employee benefits challenges while reducing plan expenses and improving efficiency, compliance and the participant experience.

Jake Belter and Gerald Dorman join Mobility Market Intelligence (MMI) enterprise sales team as regional directors

SALT LAKE CITY, Utah /Massachusetts Newswire - National News/ -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, today announced it has hired mortgage industry veterans Jake Belter, CMB(r), and Gerald Dorman to its enterprise sales team. As regional directors, Belter and Dorman will be tasked with expanding MMI's growing roster of mortgage enterprise clients.

Shawn Ansley promoted to Chief Information Officer at Vice Capital Markets

NOVI, Mich. /Massachusetts Newswire - National News/ -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today that it has promoted Shawn Ansley to chief information officer (CIO). As CIO, Ansley will be tasked with the continued development of information technologies and deepening integrations with the agencies and major loan origination systems.

Down Payment Resource releases INFOGRAPHIC: Q1 2022 Homeownership Program Index

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced the release of its latest Homeownership Program Index (HPI). The firm's analysis of 2,238 homebuyer assistance programs in its DOWN PAYMENT RESOURCE® database revealed that the net number of homebuyer assistance programs increased by 46 from Q4 2021 to Q1 2022.

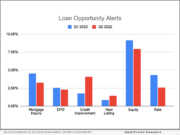

2022/Q1 Mortgage Market Opportunities Report released by Sales Boomerang

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q1 2022 report showed an increase in purchase and home-equity loan opportunities that could help lenders offset dwindling refi volume.

ACES Mortgage QC Trends Report covering the third quarter (Q3) of 2021 shows Critical Defect Rate Drops 18%

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering the third quarter (Q3) of 2021. The latest report provides an analysis of post-closing quality control data derived from ACES Quality Management & Control® software.

NotaryCam, a Stewart-owned company, serves one million remote online notarization transactions

NEWPORT BEACH, Calif. /Massachusetts Newswire - National News/ -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization and identity verification/authentication technology for real estate and legal transactions, today announced it has performed more than 1 million successful remote online notarization (RON) transactions. Since 2012, NotaryCam has facilitated transactions for Fortune 500 companies, banks, mortgage lenders, attorneys, settlement agents and more across the globe.

Christy Moss of FORMFREE recognized for outstanding contributions in mortgage tech, named a 2022 Tech All-Star

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that the Mortgage Bankers Association (MBA) has named FormFree Chief Customer Officer Christy Moss, CMB, a 2022 Tech All-Star. Since 2002, the Tech All-Star Awards have honored leaders who have made outstanding contributions to mortgage technology.

Duane Gilkison, senior director of loan quality at Fannie Mae, to Speak at ACES ENGAGE 2022

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has added Duane Gilkison, senior director of loan quality at Fannie Mae, to its speaker line-up for the upcoming ACES ENGAGE conference, taking place at the historic Broadmoor Hotel in Colorado Springs, May 23 - 25, 2022.

Sales Boomerang is #19 on 2022 list of The Americas’ Fastest Growing Companies, as ranked by The Financial Times

BALTIMORE, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it has clinched a top spot on Financial Times' ranking of The Americas' Fastest Growing Companies, ranking 19th overall, first among fintech firms and third in technology.

ReverseVision and Mortgage Coach to help consumers compare ‘forward’ and reverse mortgage financing options

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, today announced an integration with ReverseVision, a subsidiary of Constellation Mortgage Solutions, Inc., the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology.

FormFree and Take3Tech pertner to bring AccountChek asset, income and employment verification to the LoanMAPS platform

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced it has partnered with Take Three Technologies (Take3Tech) to make its AccountChek® automated asset, income, and employment verification solutions available within LoanMAPS™, an all-in-one loan origination platform that encompasses a loan origination system (LOS), point-of-sale system (POS), customer relationship management system (CRM), compliance monitoring and report generation.

New Mortgage Coach partnership enables Planet Home Lending to grow its marketing technology (martech) offering to its MLOs

MERIDEN, Conn. /Massachusetts Newswire - National News/ -- Planet Home Lending, LLC, a national mortgage lender and servicer, has selected Mortgage Coach to give loan officers a tool to provide a better customer experience. With Mortgage Coach, mortgage loan originators (MLOs) can offer borrowers modern, consultative service with digital, interactive presentations that illustrate the costs and benefits of mortgage loan products and strategies over time.

ACES Audit Solution will help Minnesota Housing Finance Agency increase transparency and accountability into its mortgage operations

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the Minnesota Housing Finance Agency has selected ACES' flagship platform ACES Quality Management & Control® software to support its mortgage origination compliance and quality control (QC).

Eric Lapin named chief strategy officer at FormFree, a top-tier mortgage technology firm

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that it has appointed Eric Lapin to the role of chief strategy officer (CSO). In this position, Lapin will leverage his more than 25 years' experience in leadership roles at marquee mortgage technology firms and financial institutions to steer the strategic vision and partnerships driving FormFree's growth.

FormFree AccountChek selected by George Mason Mortgage to streamline verification of borrower assets and income

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that Washington, D.C.-based George Mason Mortgage (GMM) has selected AccountChek® as the regional lender's exclusive provider of automated asset, income and employment verification services. GMM will use AccountChek to simplify the loan application experience for borrowers, improve productivity for its team of 120 mortgage loan officers and reduce loan cycle times.

Mid America Mortgage, Inc. welcomes mortgage industry veteran, Kyle Hilton as its newest quality control manager

ADDISON, Texas /Massachusetts Newswire - National News/ -- Mid America Mortgage, Inc. (Mid America) welcomes mortgage industry veteran, Kyle Hilton as its newest quality control manager. Hilton brings a knowledge spanning more than 20 years in mortgage underwriting and quality assurance review. In this role, Hilton will be responsible for overseeing and monitoring quality control vendors and policies.

FormFree names Mary Costello director of vendor management, risk and compliance

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree today announced that it has welcomed 17-year finance industry veteran Mary Costello to its team as director of vendor management, risk and compliance. In this role, Costello will support FormFree's audit, risk and compliance efforts across the management of internal and external vendor, lender and integration partnerships.

The Spokane Association of REALTORS (SAR) has partnered with Down Payment Resource (DPR)

SPOKANE, Wash. /Massachusetts Newswire - National News/ -- The Spokane Association of REALTORS (SAR) today announced that it has partnered with Down Payment Resource (DPR) to provide its 2,500 MLS subscribers with access to DPR's toolset that helps real estate agents connect clients with programs that can help save on down payments and closing costs.

Sales Boomerang and Bonzo partner to enable automated mortgage marketing with personality

BALTIMORE, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced its integration with Bonzo, an omnichannel sales engagement platform designed to scale the voice of mortgage advisors so they can attract, convert and retain clients on autopilot.

Promontory MortgagePath listed on 2022 HousingWire Tech100

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC announced it's been recognized by industry trade publication HousingWire in its annual Tech 100 list for the second consecutive year. The award program is designed to showcase the most innovative technology companies in the housing economy.