Tag: FinTech

MCTlive! Capital Markets Platform is First to Integrate with Freddie Mac Cash Settlement Purchase Statement API

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- MCT's award-winning capital markets platform, MCTlive!, is the first to integrate with Freddie Mac’s Cash Settlement Purchase Statement API. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Freddie Mac purchase data directly, instead of waiting to run reports through a Loan Origination System (LOS).

Vice Capital Markets is one of the first to release Freddie Mac Cash Purchase Statement API

NOVI, Mich. /Massachusetts Newswire - National News/ -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today that it is one of the first Freddie Mac-integrated Secondary Market Advisors (SMAs) to release an integration for Freddie Mac's Cash Settlement Purchase Statement application programming interface (API).

PitBullTax Software Named one of the Fastest Growing Private Companies in America on the 2022 INC 5000

CORAL SPRINGS, Fla. /Massachusetts Newswire - National News/ -- PitBullTax Software, the Nation's Leading Tax Resolution Software for CPAs, EAs and Tax Attorneys has revealed it has won a spot on the 2022 Inc. 5000 list of the fastest growing private companies in America.

John Gust joins Digital Mortgage Tech Firm, Promontory MortgagePath, as Director of Product Management

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced industry veteran John Gust has joined the organization as the director of product management. In this role, Gust leads the product management and user experience teams and is responsible for product strategy, planning, execution, and rollout of Promontory MortgagePath's mortgage fulfillment services and end-to-end technology solution.

HomeScout and FormFree partnership to help lenders identify mortgage-ready borrowers earlier in home buying journey

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® has partnered with HomeScout, a wholly owned subsidiary of FirstClose®, to launch HomeScout Qualified Borrower, a tool that helps lenders generate leads and concentrate borrower conversion efforts on mortgage-ready home buyers.

The Sammys 2022: After, Inc. QuickSuite Named a ‘Product of the Year’

NORWALK, Conn. /Massachusetts Newswire - National News/ -- After, Inc. announced today that it received "Product of the Year" in the 2022 Sales and Marketing Technology Awards program (The Sammys) for its QuickSuite® post-sale customer experience technology. The Sammys honors organizations and products helping to solve the challenges businesses have connecting and collaborating with prospects and customers.

ACES Quality Management software updated to align with recent mortgage quality control (QC) reporting recommendations issued by Fannie Mae

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that it has enhanced its reporting library within its flagship audit platform ACES Quality Management & Control® Software to help align with recent mortgage quality control (QC) reporting recommendations issued by Fannie Mae.

Mortgage Coach was implemented to provide Keller Mortgage borrowers with personalized mortgage advice supported by digital home loan presentations

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Keller Mortgage has made Mortgage Coach available to loan officers enterprise-wide.

NotaryCam eClose360 update delivers a better user experience for both notaries and document signers

NEWPORT BEACH, Calif. /Massachusetts Newswire - National News/ -- NotaryCam®, the pioneering leader in online notarization and original provider of mortgage eClosing solutions, announced today that it has made updates to its eClose360® platform to expand its capabilities and deliver a better user experience for both notaries and document signers.

Sales Boomerang announced the launch of its newest automated alert offering, Life Event Alerts

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the launch of its newest automated alert offering, Life Event Alerts, which notify mortgage advisors when a borrower or a prospect in their customer database experiences a major life change that could alter their financial situation and/or goals.

After, Inc. QuickCover Extension Now Available on Top eCommerce App Stores: Shopify, Adobe Commerce, Woo Commerce and BIG Commerce

NORWALK, Conn. /Massachusetts Newswire - National News/ -- After, Inc., a pioneer in the Warranty Services industry, just announced that its QuickCover® product protection technology is officially available on Shopify, Adobe Commerce, Woo Commerce, and BIG Commerce. QuickCover® is one of five post-sale customer experience platforms that After, Inc. calls its QuickSuite.

PitBullTax Software Integrates with Major Tech Companies to Further Dominate IRS Tax Resolution Solution Industry

CORAL SPRINGS, Fla. /Massachusetts Newswire - National News/ -- PitBullTax Software, the Nation's Leading IRS Tax Resolution Software for CPAs, EAs and Tax Attorneys has announced the release of Version 7.0. PitBullTax Software has licensees in all 50 states that rely on their software to prepare their clients' IRS resolution cases.

FormFree announces support for new Freddie Mac Loan Product Advisor enhancement is designed to expand sustainable homeownership

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® announced that mortgage lenders using AccountChek® verification of asset (VOA) reports in conjunction with a Freddie Mac Loan Product Advisor® (LPA℠) solution will soon benefit from an enhancement that takes loan applicants' 12-month on-time rent payment history into consideration when assessing eligibility for qualified first-time homebuyers.

Ruoff Mortgage Selects ACES Quality Management to Improve Loan Quality Across Multiple Product Lines

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced that Ruoff Mortgage Company, Inc. (Ruoff Mortgage), a full-service residential mortgage lender, has selected its flagship audit platform ACES Quality Management & Control® Software to support the company's origination and servicing quality control (QC) audits.

Sales Boomerang and Mortgage Coach Announce Merger and new CEO

OWINGS MILLS, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, and Mortgage Coach, a platform empowering mortgage lenders to educate borrowers with interactive home loan presentations, today announced their merger and the appointment of SaaS executive Richard Harris as CEO.

Lender Price Launches Marketplace 2.0, Providing Wholesale Lenders with Enhanced Pricing Capabilities and Deal Intelligence

PASADENA, Calif. /Massachusetts Newswire - National News/ -- Lender Price, a leading provider of product, pricing and eligibility technology, announced today they have released Marketplace 2.0, a major enhancement to their Broker Marketplace platform, one of the largest communities of wholesale brokers in the mortgage industry.

MCT Announces New MSR Technology to Empower MSR Buyers with Live Loan-Level Pricing

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, has announced today a new technology for mortgage servicing rights (MSR) buyers to produce more granular pricing for mortgage servicing. The feature leverages an application programming interface (API) to connect MSRlive!, MCT's state-of-the-art MSR valuation platform to clients' systems for more precise and accurate loan-level pricing in real time.

Mortgage QC Industry Trends Report for Q4 2021 Shows Critical Defect Rate Rose to 1.95%

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the fourth quarter (Q4) and full calendar year (CY) of 2021. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

Mortgage Markets CUSO, LLC has implemented Mortgage Coach to grow mortgage lending engagement at the credit unions it serves

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Mortgage Markets CUSO, LLC has implemented Mortgage Coach to grow mortgage lending engagement at the credit unions it serves.

2022 ACES ENGAGE Event: ACES Quality Management Unveils Certified ACES Administrator Program

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the launch of its Certified ACES Administrator (CAA) program during its inaugural ACES ENGAGE event, held May 23-25, 2022 at the Broadmoor Hotel in Colorado Springs.

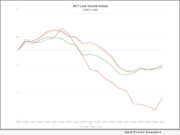

MCTlive! Lock Volume Indices – May 2022 Data announced by Mortgage Capital Trading, Inc. (MCT)

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- MCT®, the leader in capital markets software and services supporting more lenders with hedging and pipeline management solutions than any other single provider, is pleased to present the MCTlive! Lock Volume Indices for May 2022.

Sales Boomerang welcomes Cheryl Messner to oversee its customer experience department

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it has tapped Cheryl Messner to manage its customer experience departments. In her new role, Messner will define strategies to enhance Sales Boomerang's customer experience, engagement, success and operations as well as help the company build upon its growth from a fintech startup to the industry's leading borrower intelligence solution.

U.S. mortgage lenders now able to use FormFree AccountChek to satisfy Freddie Mac’s reverification of employment requirement

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that its AccountChek® digital asset verification service supports a new enhancement to Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution that makes assessment of borrower employment easier, faster, less expensive and more fraud-resistant.

MISMO Certifies Fintech Leader, DocMagic’s Total eClose Platform and Proprietary RON Technology

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of compliant loan document generation, automated regulatory compliance and comprehensive eMortgage services, announced that it attained MISMO's eClosing System and remote online notarization (RON) certifications for its Total eClose™ solution.

DocMagic’s Lori Johnson named to 2022 Most Powerful Women in Fintech List

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of fully-compliant loan document generation, regulatory compliance, and comprehensive eMortgage services, announced that its director of client services, Lori Johnson, has been recognized by PROGRESS in Lending Association as a leading female technology professional in the mortgage industry.

DocMagic, the premier provider of loan document generation, announced an integration with Empower, Black Knight’s loan origination system

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of loan document generation, compliance support and comprehensive eMortgage services, announced an integration with Empower, Black Knight's loan origination system (LOS), to help automate the DocMagic document generation process for lenders and provide access to additional DocMagic services.

Agile Launches Agile Chat for Lenders and Broker Dealers, Enhances Transparency and Efficiency for MBS Trading

PHILADELPHIA, Pa. /Massachusetts Newswire - National News/ -- Agile, a groundbreaking fintech bringing mortgage lenders and broker dealers onto a single electronic platform, today announced the launch of Agile Chat, a new chat feature designed to increase transparency and efficiency between lenders and broker dealers.

Down Payment Resource analysis finds that 63% of realMLS listings may be eligible for down payment assistance

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- realMLS, serving 11,000 members in Northeast Florida, today announced that it has partnered with Down Payment Resource (DPR) to enhance its platform with DPR's suite of real estate agent tools that help MLS customers connect homebuyers with homebuyer assistance programs.

David Bowser named VP, Customer Engagement at Mortgage Coach, Suzanne Duniphin named VP, Customer Experience

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced the advancement of two of its department directors to vice president-level positions. Suzanne Duniphin was promoted from director of eLearning to VP, customer experience, and David Bowser was promoted from director of account management to VP, customer engagement.

Indiana-based Centier Bank is now equipped to receive eNotes from their warehouse clients through DocMagic’s eVault solution

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of compliant loan document generation, automated regulatory compliance and comprehensive eMortgage services, announced that Indiana-based Centier Bank is now equipped to receive eNotes from their warehouse clients through DocMagic's eVault solution. The move positions Centier to secure more business as mortgage bankers increasingly adopt eClosing technology.

Logix Federal Credit Union chooses Mortgage Coach to enhance mortgage advisory service with interactive Total Cost Analysis loan presentations

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, announced today that Logix Federal Credit Union (Logix) has rolled out Mortgage Coach to enhance the mortgage advisory service it provides to members.

MCT (Mortgage Capital Trading), a leading mortgage tech firm, named a 2022 HousingWire Tech100 Mortgage Winner

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- Mortgage Capital Trading (MCT®), a leading mortgage hedge advisory and secondary marketing software firm, was announced as a 2022 HousingWire Tech100 Mortgage Winner. The Tech100 Mortgage Award spotlights innovators that are making the housing sector better and more sustainable by increasing efficiency, improving borrower experience and bringing elasticity to mortgage origination and servicing processes.

Shawn Ansley promoted to Chief Information Officer at Vice Capital Markets

NOVI, Mich. /Massachusetts Newswire - National News/ -- Vice Capital Markets, a leading mortgage hedge advisory firm for independent lenders, banks and credit unions, announced today that it has promoted Shawn Ansley to chief information officer (CIO). As CIO, Ansley will be tasked with the continued development of information technologies and deepening integrations with the agencies and major loan origination systems.

ACES Mortgage QC Trends Report covering the third quarter (Q3) of 2021 shows Critical Defect Rate Drops 18%

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Trends Report covering the third quarter (Q3) of 2021. The latest report provides an analysis of post-closing quality control data derived from ACES Quality Management & Control® software.

NotaryCam, a Stewart-owned company, serves one million remote online notarization transactions

NEWPORT BEACH, Calif. /Massachusetts Newswire - National News/ -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization and identity verification/authentication technology for real estate and legal transactions, today announced it has performed more than 1 million successful remote online notarization (RON) transactions. Since 2012, NotaryCam has facilitated transactions for Fortune 500 companies, banks, mortgage lenders, attorneys, settlement agents and more across the globe.

Duane Gilkison, senior director of loan quality at Fannie Mae, to Speak at ACES ENGAGE 2022

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, has added Duane Gilkison, senior director of loan quality at Fannie Mae, to its speaker line-up for the upcoming ACES ENGAGE conference, taking place at the historic Broadmoor Hotel in Colorado Springs, May 23 - 25, 2022.

Sales Boomerang is #19 on 2022 list of The Americas’ Fastest Growing Companies, as ranked by The Financial Times

BALTIMORE, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced that it has clinched a top spot on Financial Times' ranking of The Americas' Fastest Growing Companies, ranking 19th overall, first among fintech firms and third in technology.

ReverseVision and Mortgage Coach to help consumers compare ‘forward’ and reverse mortgage financing options

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, today announced an integration with ReverseVision, a subsidiary of Constellation Mortgage Solutions, Inc., the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology.

FormFree and Take3Tech pertner to bring AccountChek asset, income and employment verification to the LoanMAPS platform

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced it has partnered with Take Three Technologies (Take3Tech) to make its AccountChek® automated asset, income, and employment verification solutions available within LoanMAPS™, an all-in-one loan origination platform that encompasses a loan origination system (LOS), point-of-sale system (POS), customer relationship management system (CRM), compliance monitoring and report generation.

New Mortgage Coach partnership enables Planet Home Lending to grow its marketing technology (martech) offering to its MLOs

MERIDEN, Conn. /Massachusetts Newswire - National News/ -- Planet Home Lending, LLC, a national mortgage lender and servicer, has selected Mortgage Coach to give loan officers a tool to provide a better customer experience. With Mortgage Coach, mortgage loan originators (MLOs) can offer borrowers modern, consultative service with digital, interactive presentations that illustrate the costs and benefits of mortgage loan products and strategies over time.

ACES Audit Solution will help Minnesota Housing Finance Agency increase transparency and accountability into its mortgage operations

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the Minnesota Housing Finance Agency has selected ACES' flagship platform ACES Quality Management & Control® software to support its mortgage origination compliance and quality control (QC).

Ben Itkin Assumes Sales Leadership Position at MCT (Mortgage Capital Trading)

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- Mortgage Capital Trading, Inc. (MCT®), a recognized industry leader in mortgage risk management providing pipeline hedging, best execution loan sales and centralized lock desk services, announced today that Ben Itkin has been appointed the new National Sales Director.

Eric Lapin named chief strategy officer at FormFree, a top-tier mortgage technology firm

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that it has appointed Eric Lapin to the role of chief strategy officer (CSO). In this position, Lapin will leverage his more than 25 years' experience in leadership roles at marquee mortgage technology firms and financial institutions to steer the strategic vision and partnerships driving FormFree's growth.

FormFree AccountChek selected by George Mason Mortgage to streamline verification of borrower assets and income

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that Washington, D.C.-based George Mason Mortgage (GMM) has selected AccountChek® as the regional lender's exclusive provider of automated asset, income and employment verification services. GMM will use AccountChek to simplify the loan application experience for borrowers, improve productivity for its team of 120 mortgage loan officers and reduce loan cycle times.

FormFree names Mary Costello director of vendor management, risk and compliance

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree today announced that it has welcomed 17-year finance industry veteran Mary Costello to its team as director of vendor management, risk and compliance. In this role, Costello will support FormFree's audit, risk and compliance efforts across the management of internal and external vendor, lender and integration partnerships.

The Spokane Association of REALTORS (SAR) has partnered with Down Payment Resource (DPR)

SPOKANE, Wash. /Massachusetts Newswire - National News/ -- The Spokane Association of REALTORS (SAR) today announced that it has partnered with Down Payment Resource (DPR) to provide its 2,500 MLS subscribers with access to DPR's toolset that helps real estate agents connect clients with programs that can help save on down payments and closing costs.

Sales Boomerang and Bonzo partner to enable automated mortgage marketing with personality

BALTIMORE, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced its integration with Bonzo, an omnichannel sales engagement platform designed to scale the voice of mortgage advisors so they can attract, convert and retain clients on autopilot.

MCT Mortgage Capital Trading Integrates with Fannie Mae’s Connect Whole Loan Purchase Advice Seller API

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- MCT's award-winning capital markets platform, MCTlive!, is now integrated with the Fannie Mae Connect™ Whole Loan Purchase Advice Seller API. This API connection allows MCT Mark-to-Market and Hedge Accounting Reports to be updated with Fannie Mae purchase data instantly, instead of waiting to run reports through a Loan Origination System (LOS).

HomeBinder Adaptive Home Value tool keeps homeowners coming back to mortgage lenders, home inspectors with equity-building insights

BOSTON, Mass. /Massachusetts Newswire/ -- HomeBinder, a centralized home management platform that keeps homeowners connected with mortgage lenders, home inspectors, Realtors and other authorized professionals, today announced the availability of its Adaptive Home Value™ tool. The tool paints a more accurate picture of a home's value by taking into consideration property-specific details that other automated valuation models (AVMs) fail to consider.

Mortgage Coach enhances integration with Surefire CRM to support lenders with mortgage education that helps convert borrowers at scale

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, today announced an enhanced integration with Surefire, Black Knight's customer relationship management (CRM) and marketing automation software designed specifically for the mortgage lending industry.

Former ICE and Home Depot finance exec Patrick Rutherford named Chief Financial Officer at FormFree

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree today announced that it has appointed Patrick Rutherford, former finance executive at Intercontinental Exchange (NYSE: ICE), as chief financial officer (CFO). In his new role at FormFree, Rutherford will lead the organization's finance, accounting and compliance functions.

Take Three Technologies’ LoanMAPS LOS Now Integrated with DocMagic Eliminating Need for Disclosure Desk and Closing Dept.

TORRANCE, Calif. /Massachusetts Newswire - National News/ -- DocMagic, Inc., the premier provider of fully-compliant loan document preparation, regulatory compliance, and comprehensive eMortgage services, is pleased to announce that it has integrated multiple digital lending solutions with Take Three Technologies' ("Take3") cloud-based and fully-integrated loan origination system (LOS), LoanMAPS™.

Sales Boomerang and OptifiNow partner to offer mortgage lenders an integrated experience for customer engagement

BALTIMORE, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced its application programming interface (API) integration with OptifiNow, a cloud-based sales, marketing and customer relationship management (CRM) platform. The integration ensures accurate borrower data flows seamlessly and automatically between the two systems, giving lenders more time to focus on nurturing borrower relationships and exceeding sales goals.

AccountChek digital asset verification joins forces with Freddie Mac for automated assessment of direct deposit income

ATHENS, Ga. /Massachusetts Newswire - National News/ -- FormFree® today announced that its AccountChek® digital asset verification service will support a first-of-its-kind solution from Freddie Mac that allows mortgage lenders to assess a prospective homebuyer's income using direct deposit data. Available to mortgage lenders nationwide, Freddie Mac's Loan Product Advisor® (LPASM) asset and income modeler (AIM) solution fulfills mortgage verification of assets (VOA) and verification of income (VOI) requirements.

Promontory MortgagePath endorsed by National Bankers Association for Digital Mortgage Fulfillment and POS Technology

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Leading digital mortgage and fulfillment solutions provider Promontory MortgagePath LLC today announced the National Bankers Association (NBA) has endorsed its mortgage fulfillment services and proprietary point-of-sale technology, Borrower Wallet®.

Marcy Ash, AMP, joins Down Payment Resource as director of strategic projects

ATLANTA, Ga. /Massachusetts Newswire - National News/ -- Down Payment Resource (DPR), the nationwide database for U.S. homebuyer assistance programs, today announced it has appointed Marcy Ash, AMP, as director of strategic projects. In her role at DPR, Ash will manage relationships with state Housing Finance Agencies (HFAs) and spearhead industry partnerships and strategies that help DPR deliver greater value to its customers.

Spring EQ Wholesale products are now available in Lender Price’s Marketplace, Serving Mortgage Industry

PASADENA, Calif. /Massachusetts Newswire - National News/ -- Lender Price, a provider of mortgage loan pricing and origination technology, announced today that Spring EQ has joined the Lender Price Marketplace as the first home equity loan lender on the platform. Spring EQ, headquartered in Philadelphia, is one of the nation's largest lenders of home equity products.

New Jersey Bankers Association has officially endorsed Promontory MortgagePath mortgage fulfillment services

DANBURY, Conn. /Massachusetts Newswire - National News/ -- Promontory MortgagePath LLC, a leading provider of comprehensive digital mortgage and fulfillment solutions, announced today the New Jersey Bankers Association (NJBankers) has officially endorsed its mortgage fulfillment services and proprietary point-of-sale technology Borrower Wallet®.

ACES Quality Management adds Economist Dr. Edward Seiler to 2022 ACES ENGAGE agenda

DENVER, Colo. /Massachusetts Newswire - National News/ -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced it has added Dr. Edward Seiler, housing economist at the Mortgage Bankers Association (MBA) and executive director of the MBA's think tank Research Institute for Housing America, to its speaker line-up for the upcoming ACES ENGAGE conference.

NAMMBA and Mortgage Coach expand partnership for 2022 to grow diversity, equity and inclusion in housing finance

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, has expanded its relationship with the National Association of Minority Mortgage Bankers of America (NAMMBA).

Enhancements to Sales Boomerang’s Rate Alert improve its accuracy, timeliness and ease of use for Mortgage Lenders

BALTIMORE, Md. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today announced the launch of Reverse Mortgage Alert, a new addition to its pantheon of automated borrower intelligence products, as well as significant enhancements to the company's existing Rate Alert product.

ReverseVision Recruits Marketing Maven Scott Shepherd – leading reverse mortgage software firm continues expansion

SAN DIEGO, Calif. /Massachusetts Newswire - National News/ -- ReverseVision®, the leading national provider of Home Equity Conversion Mortgage (HECM) and private reverse mortgage sales and origination technology, announced that seasoned marketing executive Scott Shepherd has joined the company to head its marketing efforts. As head of marketing, he oversees ReverseVision's marketing department and is responsible for the design and implementation of its new marketing strategy.

Mortgage Coach unveils redesigned web portal with immersive brand exploration opportunities, and library of lender resources

IRVINE, Calif. /Massachusetts Newswire - National News/ -- Mortgage Coach, a borrower conversion platform empowering mortgage lenders to educate borrowers with interactive presentations that model home loan performance over time, has announced the launch of a newly designed website. The website redesign offers visitors an enhanced user experience featuring immersive brand exploration opportunities and an enriched library of lender resources.

Accentf(x) acquired by After, Inc. to expand post-sale marketing solutions

NORWALK, Conn. /Massachusetts Newswire - National News/ -- After, Inc., the leading customer experience technology company providing post-sale software and services to the world's top manufacturers, retailers, and ecommerce sellers, just announced its acquisition of Accentf(x) Marketing.

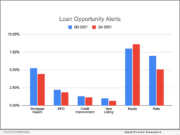

Home-equity gains signal a shift in the kinds of opportunities that will dominate lenders’ pipelines in 2022 says SALES BOOMERANG

WASHINGTON, D.C. /Massachusetts Newswire - National News/ -- Sales Boomerang, the mortgage industry's top-rated automated borrower intelligence and retention system, today released its latest Mortgage Market Opportunities Report. The Q4 2021 report identified increasing opportunities for mortgage lenders to assist borrowers with tappable home equity, lending credence to analysts' expectations for a surge in home-equity-related mortgage activity in 2022.